Learn about the Small Coin Strategy

40 to 60 small cap crypto Holdings

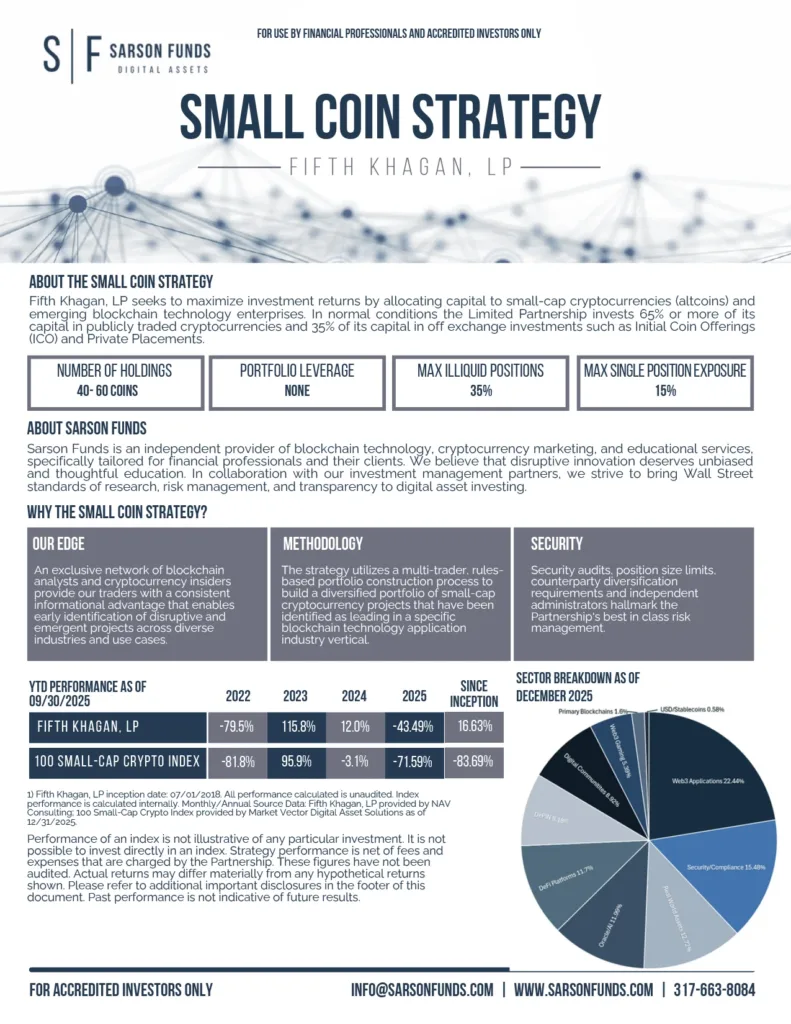

Our Small Coin Strategy (Fifth Khagan, LP) aims to offer clients a diversified portfolio of small-cap cryptocurrency holdings. By focusing on identifying undervalued and emerging coins, we maintain between 40 to 60 positions with a max exposure to any single small cap coin of 15% at any given time. This targeted approach enables us to maximize returns while minimizing risk.

Team Managed

At Sarson Funds, we take pride in our team-managed approach. Our experienced professionals collaborate to identify opportunities, monitor market trends, and make informed decisions for our clients. With a collective wealth of knowledge and expertise, our team is dedicated to delivering exceptional results.

United States Domiciled

As a US-domiciled limited partnership (hedge fund), we operate under strict regulatory oversight and scrutiny. This ensures our operations are transparent, secure, and compliant with all relevant laws and regulations. Our clients can be confident that their funds are managed with the highest standards of integrity and accountability.

No Leverage

We believe a conservative approach is essential for long-term success. Therefore, we do not use leverage or margin in our strategies. Our returns are solely driven by the performance of our underlying assets, without any unnecessary risk-taking. Our clients can trust that their capital is managed prudently, with a strong focus on preserving principal.

5+ Year Track Record

Our Small Coin Strategy (Fifth Khagan, LP) has achieved remarkable results over the past five years. With a proven track record of delivering robust returns while minimizing losses, we have established ourselves as a trusted and reliable partner for our clients.

Monthly Liquidity after 90 Days

We recognize the importance of liquidity for all our clients. Although our strategies generally involve holding positions for longer durations, we offer regular liquidity events to provide access to capital. Following an initial 90-day lock-up period, we ensure monthly liquidity to grant our clients the flexibility they require.

Click the FactCard below to download

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

Small Coin Strategy Awards

This fund was ranked based on the data in BarclayHedge’s Managed Futures Database.

Request

Information

Submit this request form to receive investor information.