Learn about the Large Coin Strategy

Top 10 Cryptocurrencies

Our Large Coin Strategy (Blockchain Momentum, LP) utilizes a rules-based investment process to strategically diversify assets across the ten largest cryptocurrencies available for trading in the United States with a Qualified Custodian. This approach ensures a disciplined and systematic selection of top-performing cryptocurrencies, optimizing our portfolio for robust fundamentals and potential long-term growth.

Pre-Screened Holdings

Our policy for selecting cryptocurrencies is based on market cap weighting, with a minimum market cap of $1 billion. Before investing in any cryptocurrency, we thoroughly screen each potential holding to ensure it meets our standards. This includes evaluating factors such as market capitalization, trading volume, and fundamental analysis. This ensures that our clients can be confident that their funds are managed with the utmost care. Our team's extensive knowledge and expertise in the cryptocurrency space enable us to make informed decisions on behalf of our clients.

Learning Algorithms

We utilize sophisticated learning algorithms to analyze market trends, identify patterns, and make informed investment decisions on behalf of our investors. These algorithms allow us to quickly adapt to changing market conditions and capitalize on new opportunities as they arise.

$1BN Market Cap Eligibility

To ensure that we're investing in only the most liquid and well-established cryptocurrencies, we require a minimum market capitalization of $1 billion for any potential holding. This threshold allows us to minimize our exposure to smaller, more speculative coins and focus on those with proven track records.

Monthly Liquidity After 90 Days

We recognize the importance of liquidity for all our clients. Although our strategies generally involve holding positions for longer durations, we offer regular liquidity events to provide access to capital. Following an initial 90-day lock-up period, we ensure monthly liquidity to grant our clients the flexibility they require.

Click the FactCard below to download

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

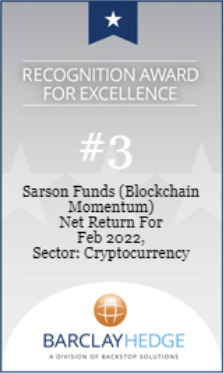

Large Coin Strategy Awards

This fund was ranked based on the data in BarclayHedge’s Managed Futures Database.

Request Information

Submit this request form to receive investor information.