Cryptocurrency Investment Strategies for Accredited Investors

Sarson Funds helps deliver risk-managed digital asset investment strategies to individual accredited investors.

Along with our ecosystem of educational resources and Wall Street-grade research, our platform delivers access to transparent investment strategies designed specifically for individual accredited investors.

Free Platform Transfers

Frictionless crypto. Manage volatility risk without costly transfers or withdrawals.

Transparent Products

Diverse, transparent, and risk-managed cryptocurrency investment products.

Investor Education Materials

Cryptocurrency and digital asset education resources for individual investors.

Get Access to Transparent digital asset investment strategies

The world of cryptocurrency and blockchain technology investment options is increasingly diverse and ever expanding. So we’ve provided investment strategies designed to deliver transparent digital asset exposure in a variety of structures. Scroll down to see our investment product line-up.

LARGE COIN STRATEGY

Blockchain Momentum LP, a BarclayHedge award winner

SMALL COIN STRATEGY

Fifth Khagan LP, a BarclayHedge award winner

CRYPTO & INCOME STRATEGY

Covered call writing on major US-traded cryptocurrencies

CRYPTO ESG STRATEGY

Focused on social impact, environmental sustainability, and financial inclusion.

SMARTCRYPTO 15 EQUAL WEIGHT INDEX

Passive exposure to the largest US traded cryptocurrencies

STABLECOIN INDEX

Equally-weighted basket of regulated US-traded Stablecoins

Want to Open an Individual Account? Our Investment Strategies are Available to Individual Accredited Investors.

CRYPTOCURRENCY 101: DIGITAL ASSET INVESTOR GUIDE

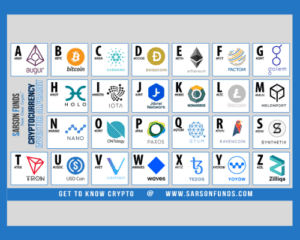

CRYPTOCURRENCY INVESTOR ALPHABET

CRYPTOCURRENCY ACT OF 2020: POLICY OVERVIEW