The Manifest Network, our trusted partner, empowers innovation in decentralization through a robust open-source AI infrastructure that prioritizes efficiency and security.

As a leader in the decentralized open-source AI movement, Manifest fosters communities that enable future generations to build freely. Positioned at the intersection of AI and Web3, the Manifest Network plays a key role in shaping the future. Through partnerships across diverse ecosystems, they drive innovation, collaboration, and democratized access to transformative technologies, revolutionizing how we build.

Learn about the Decentralized AI Strategy

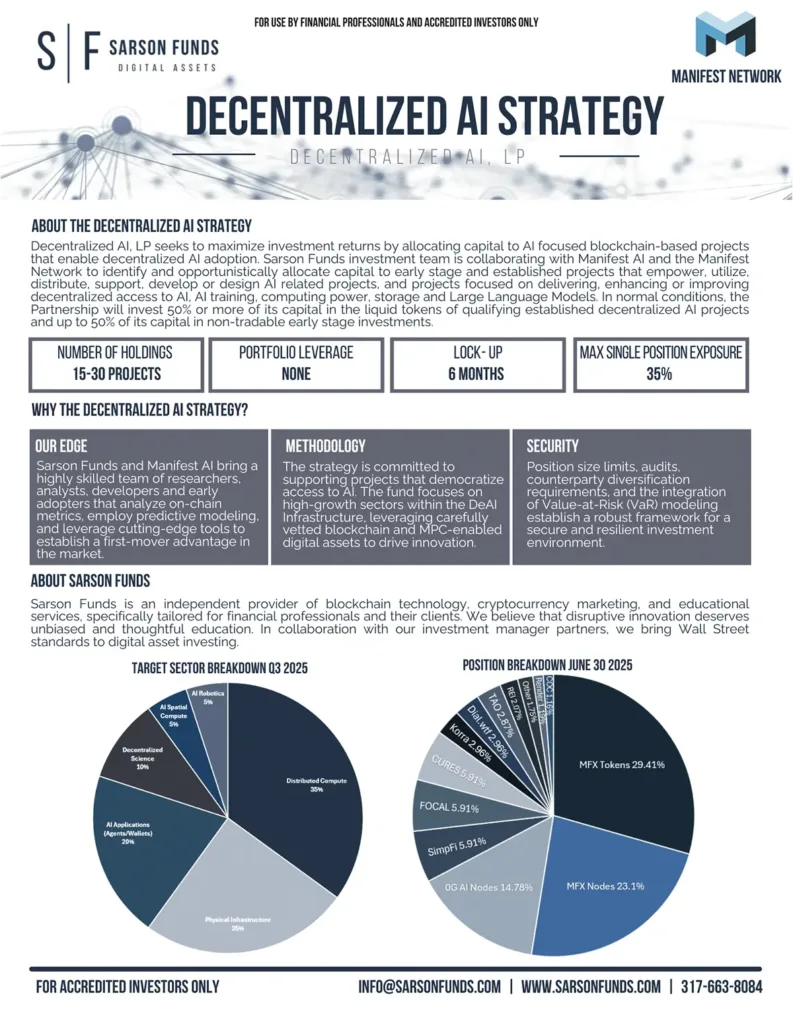

15–30 Cryptocurrency Holdings

The Decentralized AI Strategy carefully selects 15–30 cryptocurrency projects that align with its focus on AI-driven blockchain innovation. This approach ensures a diversified yet concentrated portfolio aimed at leveraging the most promising opportunities in the AI and Web3 ecosystem.

0% Portfolio Leverage

This strategy is designed to minimize risk by avoiding portfolio leverage. By maintaining a debt-free investment model, the fund focuses on sustainable growth and capital preservation in the evolving decentralized AI sector.

Monthly Liquidity After 180 Days

We recognize the importance of liquidity for all our clients. Although our strategies generally involve holding positions for longer durations, we offer regular liquidity events to provide access to capital. Following an initial 180-day lock-up period, we ensure monthly liquidity to grant our clients the flexibility they require.

Max Single Position Exposure: 25%

To ensure portfolio stability and diversification, no single position will exceed 25% of the total investment, maintaining balanced exposure across multiple cutting-edge AI blockchain projects.

Daily Rebalancing and Advanced Risk Controls

The portfolio employs daily rebalancing and advanced risk controls, such as Value-at-Risk (VaR) modeling, to ensure optimal performance and security. This disciplined approach adapts to market fluctuations while safeguarding assets.

Click the FactCard below to download

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

Request Information

Submit this request form to receive investor information.