Learn about Crypto & Income Strategy

Qualified US Listed Cryptocurrencies

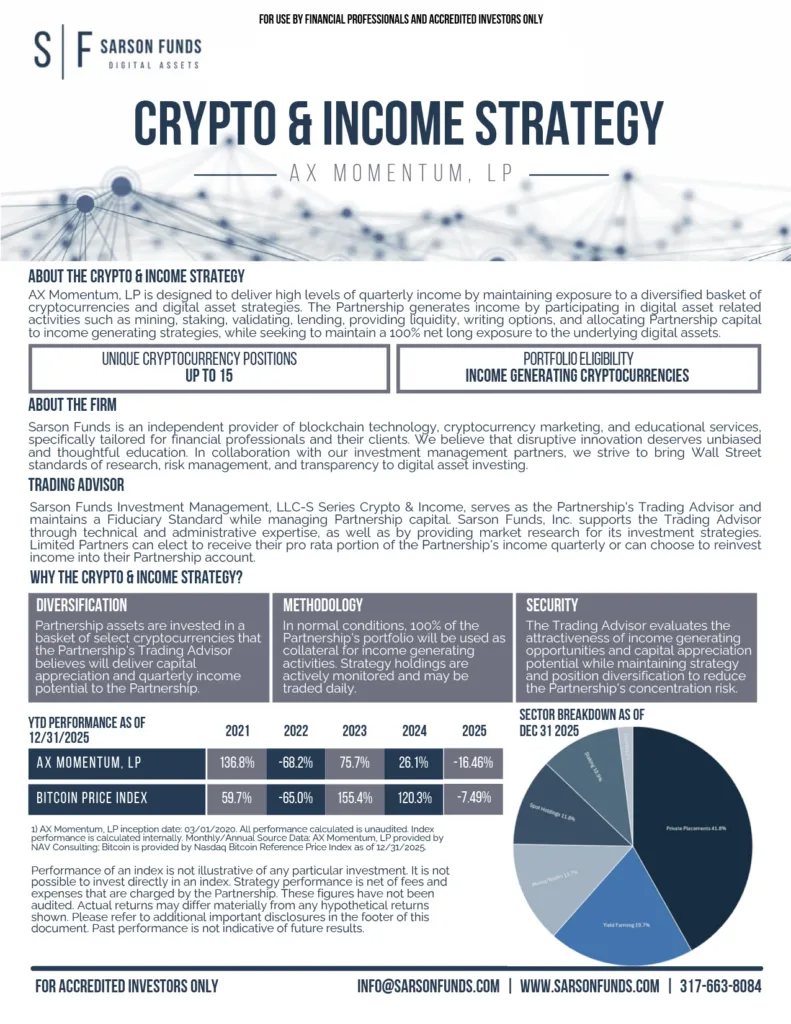

Our Crypto & Income Strategy (AX Momentum, LP) is designed to provide investors with exposure to a select group of established cryptocurrencies and their accompanied yield generating opportunities. By focusing on these established and liquid assets, we can minimize risk while still offering strong potential for returns. Our team's expertise in the cryptocurrency space ensures that we only invest in assets with strong fundamentals and a proven track record of success.

10% Target Annual Yield

Our fund is designed to deliver exceptional returns for our investors. With a target annual yield of 10%, we aim to outperform traditional investment options while still offering a level of stability and predictability that is hard to find in the cryptocurrency space. By carefully selecting our assets and employing sophisticated investment strategies, we aim to deliver consistent and reliable returns for our clients. Our focus on capital appreciation and income generation makes our fund an attractive option for investors seeking exposure to the cryptocurrency market.

Managed Volatility

We believe that volatility can be both an opportunity and a risk. The partnership's strategy uses advanced algorithms and expert analysis to optimize returns while minimizing losses. By carefully balancing our portfolio and continually refining our investment process, we aim to deliver consistent returns while minimizing the impact of volatility on our clients' portfolios.

Quarterly Income with Crypto Volatility

Our Crypto & Income Strategy (AX Momentum, LP) is designed to provide investors with quarterly income payments while maintaining exposure to the rapidly growing cryptocurrency market. By investing in a diversified portfolio of yield generating cryptocurrencies, we aim to deliver quarterly income that not only grows your wealth but also provides a sense of stability and predictability.

Monthly Liquidity after 90 Days

We recognize the importance of liquidity for all our clients. Although our strategies generally involve holding positions for longer durations, we offer regular liquidity events to provide access to capital. Following an initial 90-day lock-up period, we ensure monthly liquidity to grant our clients the flexibility they require.

Click the FactCard below to download

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

From the Fund Manager

From the Fund Manager

Crypto & Income Strategy Awards

Q2 2022

Q4 2020

Q4 2020

Q4 2020

This fund was ranked based on the data in BarclayHedge’s Managed Futures Database.

Request Information

Submit this request form to receive investor information.