Learn about the Smart Crypto 15 Strategy

Investment Process

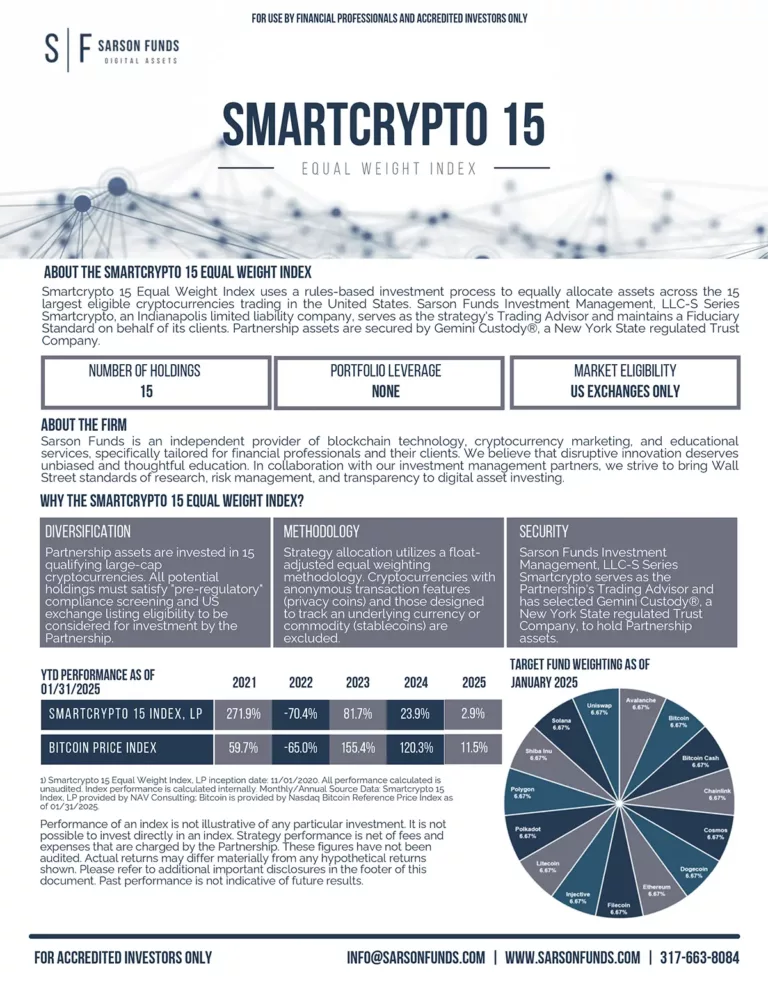

Our Smartcrypto Index (Smartcrypto15 Index, LP) follows an equal weight investment process to ensure consistency and transparency. By applying equal weight criteria for selecting and weighting the top 15 cryptocurrencies by market cap, we aim to deliver exceptional returns for our clients while minimizing the impact of emotional decision-making.

Diversify Partnership Capital

Our fund is designed to diversify partnership capital by allocating investments across a select group of pre-screened cryptocurrencies. By spreading risk across multiple assets, we aim to deliver consistent returns for our clients while minimizing the impact of any individual coin's performance. Our focus on diversification aligns with our commitment to managing risk.

15 Largest Eligible Cryptocurrencies

Our Smartcrypto Index (Smartcrypto15 Index, LP) invests in the 15 largest eligible cryptocurrencies by market capitalization weighting methodology. By focusing on the most established and liquid coins, we aim to deliver exceptional returns for our clients while minimizing the impact of market volatility. Our focus on large-cap cryptocurrencies aligns with our commitment to delivering consistent results.

Pre-Screened Holdings

Our policy for selecting cryptocurrencies is based on market cap weighting. Before investing, we thoroughly screen each potential holding to ensure it meets our standards. This includes evaluating factors such as market capitalization, trading volume, and fundamental analysis. This rigorous process ensures our clients can be confident that their funds are managed with the utmost care. Our focus on pre-screened holdings aligns with our commitment to transparency and accountability. All potential holdings must satisfy "pre-regulatory" compliance screening and US exchange listing eligibility to be considered for investment by the partnership.

Privacy and Anonymous Coins Excluded

Our Smartcrypto Index (Smartcrypto15 Index, LP) excludes coins that prioritize privacy and anonymity (privacy coins) over transparency and regulatory compliance, as well as cryptocurrencies designed to track an underlying currency or commodity (stablecoins, gold-backed tokens, etc.). By focusing on coins that are committed to regulatory oversight and transparent operations, we aim to deliver exceptional returns for our clients while minimizing the risk of market disruption.

Monthly Liquidity After 90 Days

We recognize the importance of liquidity for all our clients. Although our strategies generally involve holding positions for longer durations, we offer regular liquidity events to provide access to capital. Following an initial 90-day lock-up period, we ensure monthly liquidity to grant our clients the flexibility they require.

$250K Minimum Investment*

To ensure a consistent capital base and efficient portfolio management, we require a minimum investment of $250,000. This helps us maintain disciplined asset allocation and limits disproportionate influence from smaller positions.

*Minimum waivers may be granted on a case-by-case basis.

Click the FactCard below to download

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

Request

Information

Submit this request form to receive investor information.