Sarson Funds’ Analysis on Institutional Interest

In the ever-evolving landscape of global finance, bitcoin (BTC) has emerged as a pivotal asset class, drawing significant attention from large institutions, governments, and banks, particularly in the context of reserves. As these entities consider and begin integrating bitcoin into their portfolios, they are closely monitoring key metrics that have historically signaled market trends. One such metric, the amount of Bitcoin held on exchange platforms, has proven to be a reliable barometer for market sentiment and has been instrumental in forecasting potential price trajectories in previous market cycles. This analysis delves into the significance of exchange reserves, their historical correlation with price movements, and the current trends that suggest Bitcoin may be poised for further appreciation, particularly in light of institutional interest and the role of exchange-traded funds (ETFs).

Background on Bitcoin and Institutional Interest

Bitcoin has gained traction among large institutions, governments, and banks, who are increasingly viewing it as a strategic asset and hedge against other investment categories. As these entities consider integrating bitcoin into their portfolios, they are particularly focused on metrics that indicate market sentiment and potential price movements to inform their strategies.

Exchange Reserves as a Leading Indicator

One critical metric is the amount of Bitcoin held on exchange platforms. This indicator has historically been a strong leading signal in market cycles, often preceding periods of significant growth in Bitcoin’s market capitalization. When exchange reserves decrease, it suggests investors are moving Bitcoin to private wallets for long-term holding, reducing the available supply for trading.

Impact on Supply and Price

A decline in exchange reserves can lead to supply squeezes, especially when demand remains robust or increases. This dynamic has been associated with price increases in past bull markets, such as the 2020-2021 rally when Bitcoin’s price surged from $20,000 to $69,000 as reserves fell. Recent data, with reserves at approximately 2.46 million BTC by late 2024, mirrors this trend, suggesting potential for further appreciation.

Institutional Accumulation

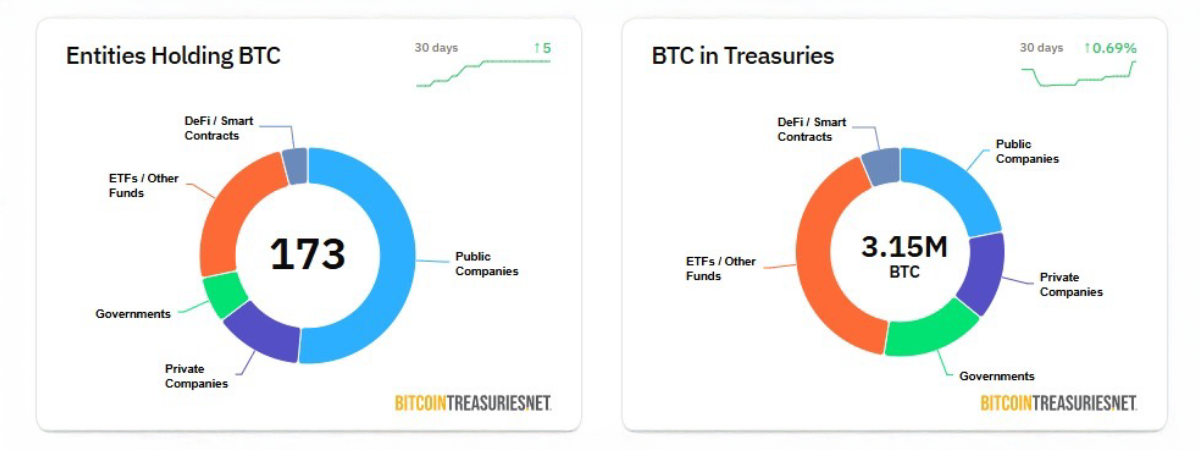

An unexpected detail is the rapid accumulation by Bitcoin ETFs, not just in the United States, which are acquiring Bitcoin at rates far exceeding mining output, potentially amplifying the impact of low exchange reserves on price dynamics. Alongside these ETFs, we are starting to explore new accumulation via retirement funds, sovereign wealth funds, and entity treasuries. These are new avenues of buying pressure that did not exist during previous cycles. These treasury balances equate to roughly 3.15m of the 21m total end supply of bitcoin as of today.

Impact on Supply Squeezes and Market Capitalization

The decline in exchange reserves has significant implications for supply dynamics, particularly in the context of institutional demand. When fewer bitcoin are available on exchanges, the supply-demand imbalance can lead to supply squeezes, where limited availability meets strong buying interest, driving prices higher. This phenomenon has been a catalyst for immense growth in Bitcoin’s market capitalization in past cycles; reduced reserves can predict short-term price movements and long-term trends. The current landscape, with institutional interest surging through Bitcoin ETFs, further amplifies this effect. The February 2025 Yahoo Finance article noted that ETFs are accumulating Bitcoin at rates 20 times faster than mining output, potentially exacerbating supply constraints and supporting market cap growth.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.