If you have ever asked whether this kind of money is truly real, you are engaging with the same question every monetary system eventually forces us to confront. Blockchain-based digital money can feel abstract because it has no physical form or government seal. For most of history, money was tangible and its legitimacy was reinforced by recognized authorities. Skepticism is reasonable.

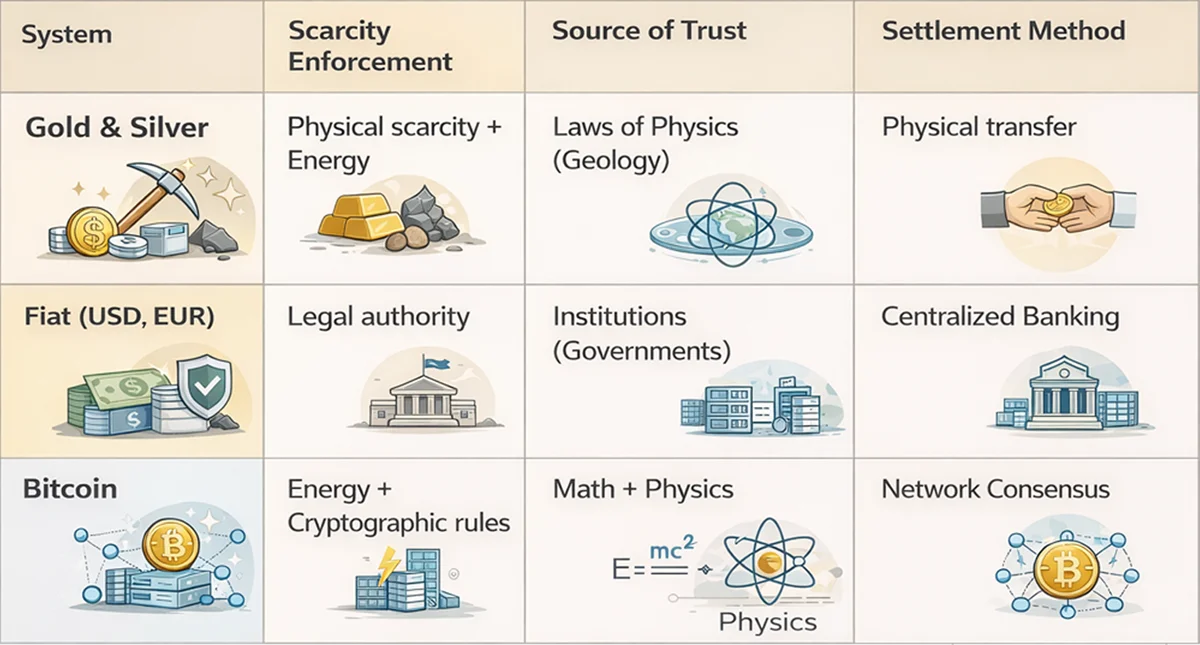

Yet the question itself points to something deeper. All forms of money derive value from the systems that enforce scarcity, trust, and settlement. None have value simply because people believe in them. Understanding this is the key to understanding modern digital monetary systems.

How Money Has Traditionally Held Value

To understand how new systems work, it helps to start with familiar ones.

Gold has held value for centuries because it is scarce and costly to extract. Its supply is constrained by geology and the real-world effort that goes into mining it. Fiat currencies such as the dollar or euro derive value from legal authority, taxation, and central bank policy. Their scarcity and stability depend on institutional credibility and governance.

These systems feel natural because their enforcement mechanisms are visible and familiar. But they are still systems. Their value depends on how well their rules are upheld.

A New Model for Monetary Enforcement

Digital monetary networks introduce a third approach. Instead of relying on physical hardness or institutional authority, they rely on rules enforced by computation and energy.

This framework rests on three elements working together. First, the system enforces its rules through real-world energy costs. Second, it operates under a fixed and transparent monetary policy hard-coded in software, with changes requiring overwhelming network agreement rather than unilateral control. Third, it gains value because individuals and institutions choose to use it. News and market events influence short-term price movements, but not the core mechanisms. Remove any one of these, and the system does not function as money.

Energy as Enforcement, Not Value Creation

At the foundation of this system is a process known as Proof of Work (PoW). Energy is not used to magically create value. It is used to enforce the rules, making fraud and arbitrary expansion nearly impossible.

Roughly every ten minutes, computers around the world compete to solve a cryptographic puzzle. The winner earns the right to add the next set of transactions to the public Bitcoin network ledger. Participation requires electricity, a real and unavoidable cost. If a participant attempts to cheat, their work is rejected and the energy spent is lost. Honesty is rewarded. Deception is penalized.

This creates a system where telling the truth is economically rational and lying is prohibitively expensive.

Anchoring a Digital System in Physical Reality

Because rules are enforced through energy expenditure, the system is tied directly to the physical world. To alter transaction history or create currency outside the established rules, an attacker would need to control more computing power than the rest of the global network combined.

The energy required to do so would rival that of entire nations. The cost makes such an attack economically irrational. Instead of trusting intermediaries or institutions, trust is placed in physics, cryptography, and open verification.

Putting Energy Use in Context

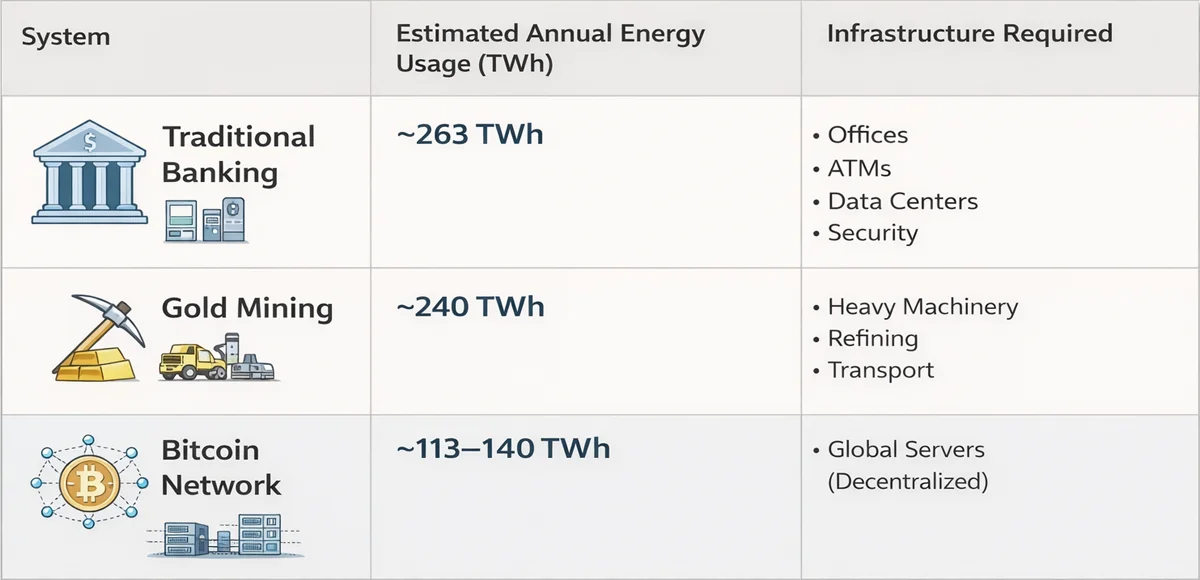

Energy consumption is often cited as a criticism, but it is rarely compared to existing systems.

The global banking system, including branches, ATMs, data centers, and armored transport, consumes roughly 263 terawatt-hours of electricity each year. Gold mining consumes about 240 terawatt-hours. Digital monetary networks consume an estimated 113 to 140 terawatt-hours annually while operating continuously and globally.

Bitcoin increasingly functions as an energy scavenger, changing the economics of waste by seeking out the cheapest and most isolated power sources available. Rather than relying primarily on the traditional electrical grid, the network now draws over 52 percent of its electricity from sustainable sources, much of it from energy that would otherwise go unused. This includes so-called estranged power, where production exceeds the ability to transmit or store it.

In practice, this means capturing the methane from oil field flaring, which reduces the carbon-equivalent impact of that gas by roughly 63 percent, as well as absorbing surplus electricity from remote hydroelectric dams or wind farms with no connection to major population centers. By acting as a flexible first buyer for thai excess capacity, mining operations can provide the revenue needed to make renewable energy projects financially viable to edge cases where they otherwise would not be.

Why Energy Does Not Explain Price Volatility

If the underlying rules are so robust, a natural question follows. Why does the price fluctuate so much?

These movements reflect changes in adoption, access, and perception, not changes to the system’s core rules. Periods of volatility often coincide with quiet progress. Infrastructure improves. Regulatory clarity increases, custody solutions mature, and financial products reduce friction to allow for easier access.

Throughout these cycles, the monetary rules remain unchanged. Supply limits and issuance schedules are fixed in code and enforced by the energy required to maintain the network. Anyone can verify and audit them independently.

A Different Way to Think About Money

This system does not require trust in rulers, vaults, or institutions. Scarcity and settlement are enforced by open-source code, real-world energy costs, and voluntary participation.

It does not replace older forms of money or value accrual overnight. It introduces a new enforcement model alongside them.

If you have ever wondered whether this form of money is real, the answer is straightforward. It is as real as the energy that enforces its rules, the code that fixes its supply, and the users who choose to use and support it.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.