Securing a Blockchain-Built Future: How Cryptography will Drive the Next Cryptocurrency Innovation Wave

With world financial system begins to embrace the wave of blockchain-powered digital assets and cryptocurrencies entering the vocabulary of Wall Street and Main Street investors alike, we look ahead to the next big wave of crypto innovation – securing a blockchain-built future.

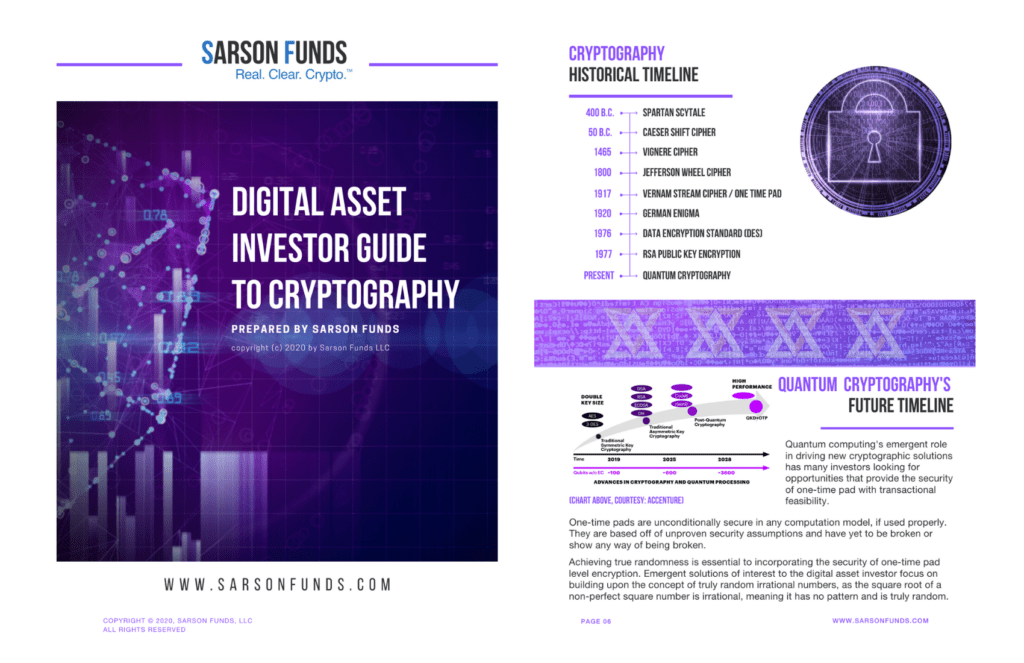

Cryptocurrencies and digital assets rely on secure, encrypted consensus to validate transactions and empower the mechanics of decentralized finance. Advances in computing processing power, and developments in quantum computing, mean the market for digital assets will need to respond with quantum resistant encryption solutions in order to propel blockchain technology to the next level of global adoption.

To educate digital asset investors, cryptocurrency financial advisors, and blockchain technology market analysts on the issues and opportunities in digital asset encryption advances, Sarson Funds is pleased to provide the first in a series of investor guides to understanding encryption and the market opportunities poised to emerge as the world’s blockchain infrastructure grows.

This first release includes two overview pieces designed specifically for digital asset investors interested in the market dynamics and investment opportunities in cryptocurrency encryption advances (available for download below):

First, is a white paper from the Sarson Funds analyst team:

The white paper is accompanied by an easy to digest compendium overview of digital asset cryptography:

We trust digital asset investors and cryptocurrency financial advisors find these resources useful as the world transitions to a new era of democratized financial, personal data sovereignty, and a secure future built on blockchain.

By Liam McDonald

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]