The Coronavirus pandemic has revealed a need for digital banking in the United States.

The United States has been accused, not always unfairly, of complacency as other countries around the world race toward digital currency adoption and claim leadership in shaping the future of digital finance. Information shared by Sarson Funds with insights into conversations happening at the highest levels in Washington, DC reveals that the United States may not be as far behind as assumed in the Blockchain Wars with China and other digital currency focused nations.

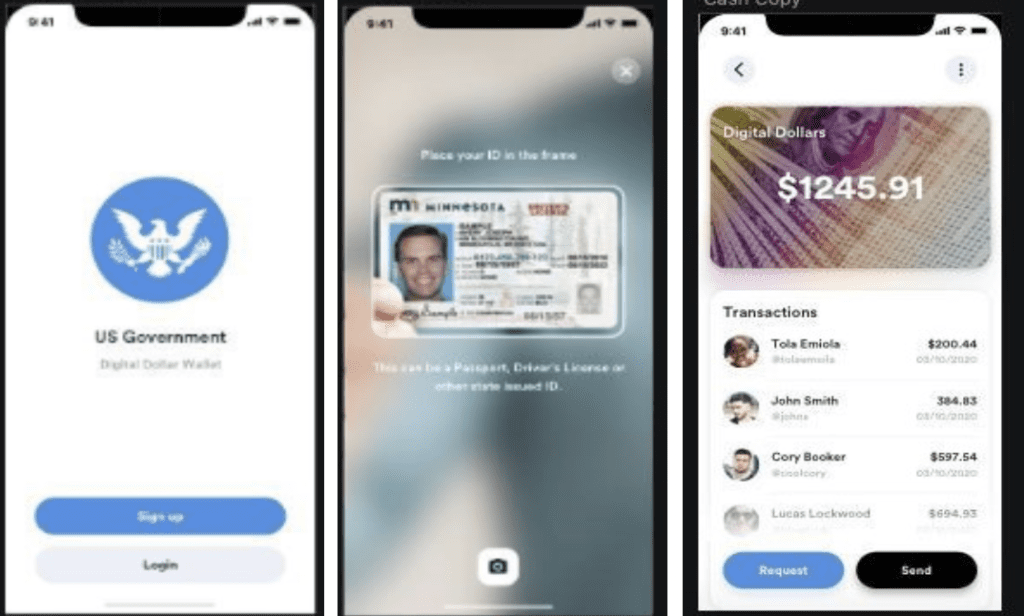

Few countries have more to gain from a rebuilding of the international financial system than China. Despite efforts to the contrary, capital restrictions on the movement of money into and out of China stopped the Chinese RMB from ever becoming a viable trade currency. China’s development of a two-tiered blockchain-based currency system – with a domestic currency and an international currency (the conversions of which must go through the PBOC) – seek to finally address this problem. China remains the global leader for the adoption of a digital currency, with digital wallets (shown below) and blockchain-based digital currencies already being implemented, such as the test programs recently launched in four Chinese cities.

John Sarson, CEO of Sarson Funds, a Wall Street-focused digital asset investment management firm, comments that he believes the digital Yuan will be the first government-backed digital dollar to be utilized worldwide.

With the digitization of the Yuan and the support of neighboring countries, it is no shock that Sarson believes the Yuan will be the first globally accepted central bank digital currency, but where is the United States in this effort?

According to Sarson, the United States is not very far behind. “The United States government works most effectively when it looks to private industry for leadership,” notes Sarson, while also saying that it is encouraging to see the US Treasury soliciting technology solutions from crypto industry veterans like Metal Pay. Sarson continues, “Metal’s digital payment platform makes distributing and receiving digital payments anywhere in the world as simple as Venmo, without the barriers for citizens without bank accounts. Moves like this will catch the U.S. up to the rest of the digital-finance world in a hurry.”

Metal is one of a small number of FDIC-insured crypto payment platforms in the United States, as it allows users to send and receive payments with 0% transaction fees on cash – a presumed must for federal partnerships.

So, while China has expressed interest in developing a compatible infrastructure for cryptocurrency coexistence, Metal Pay is pioneering the effort on the American front. According to Sarson, the United States will need to lean heavily on its private sector – and would be wise to do so – if it hopes to keep up with the increasingly digital future of finance.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]