CME Group Inc, the world’s largest futures exchange, continues to see record growth in Bitcoin Futures.

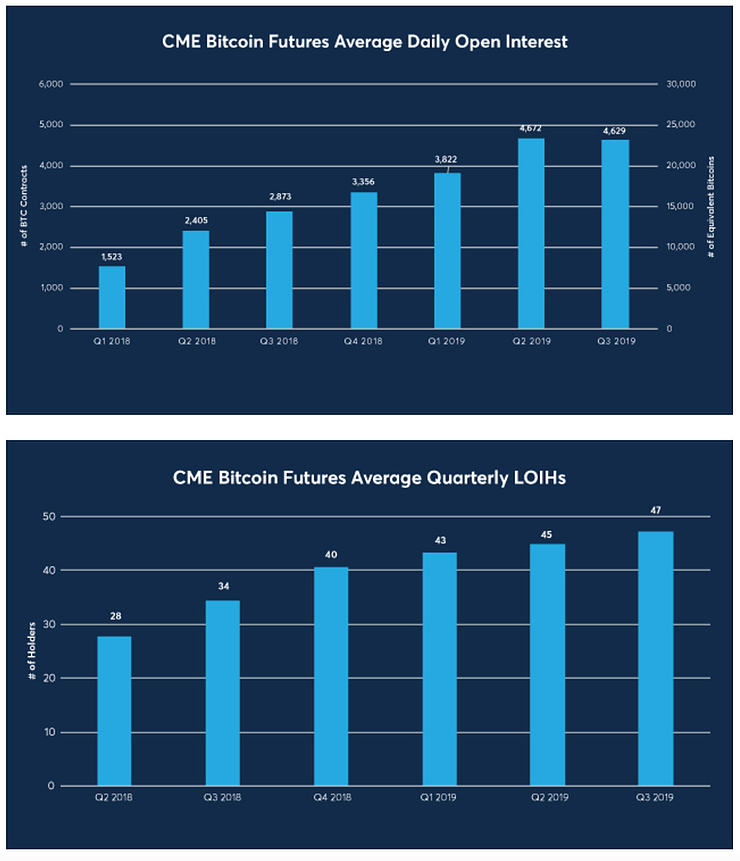

According to the recently released CME Report, greater Bitcoin market adoption led to robust volume of 5,534 contracts traded per day in Q3, +10% vs. Q3 2018 and higher than all previous quarters except Q2 2019.

Importantly, the report noted, institutional flow remained strong with 454 new accounts added, compared with 231 added in Q3 2018 (+97% growth).

CME noted that this means Bitcoin futures can provide right-sized liquidity when your need it, allowing market participants globally to efficiently hedge bitcoin risk on a trusted platform.

These were some of the notable highlights from CME’s report:

- Average daily volume (ADV) was 27,670 equivalent bitcoin or ~$289M notional value.

- Record OI of 6,128 contracts (30,640 equivalent bitcoin) achieved on July 1

- Record number of LOIH, or entities that hold 25+ BTC, hit a record high of 56 on July 9.

- ~50% of BTC volume was traded outside the U.S., with ~26% coming from APAC and ~21% from EMEA.

- 3,400+ unique, active accounts have traded since launch.

*CME Reports that’s data is accurate as of 09/30/2019.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]