Weekly Analyst Thoughts: 5/21/20

Is Bitcoin ready?

Key Takeaways:

- The cryptocurrency industry was not ready for the bull run in 2017.

- There is one thing missing from cryptocurrencies before mainstream adoption can occur: Network Scalability.

- The cryptocurrency ecosystem is not ready for another bull run without the implementation of improved scalability systems such as Ethereum 2.0.

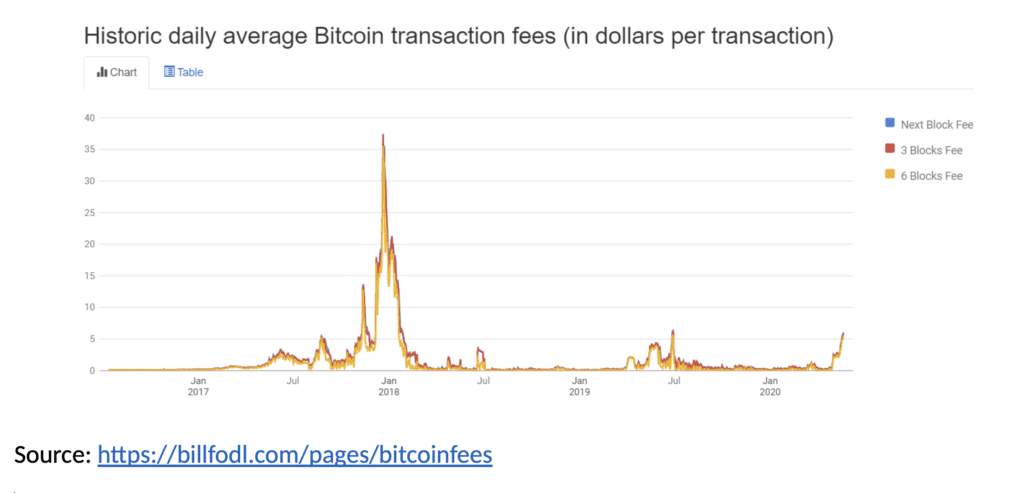

It has been almost three years since the cryptocurrency bull run of 2017 that thrust cryptocurrency into the mainstream spotlight. As Bitcoin reached an all-time high and attracted global attention, the industry quickly proved that it was not ready. BTC network transaction fees shot to over $35 (pictured below), exchanges temporarily barred new users from joining because of their inability to handle increased transaction frequency and provide ample liquidity, and crypto derivatives markets for price-betting were sparse. Although the cryptocurrency industry has come a long way in terms of institutional adoption, derivatives markets, exchange infrastructure and the burgeoning DEFI market, there is still one missing piece of the puzzle: network scalability.

Amplified network scalability is essential before universal adoption of cryptocurrencies can take place. The Bitcoin network functions properly at seven transactions per second, which was no problem for Bitcoin in its early years, however, with the exponential network growth since, instant cryptocurrency transactions are not possible without a total scalability solution.

Cryptocurrency at its core is a payment network, so if the networks cannot scale to increasing transaction frequencies, their prices will be more cyclical instead of the parabolic price performance that emerging technologies typically follow. Thus, the cryptocurrency industry is not ready for a new bull run without a highly functioning lightning network, such as Ethereum 2.0. Ethereum 2.0 provides a scalability solution for the cryptocurrency ecosystem as it transitions Ethereum from a Proof-of-Work to a Proof-of-Stake network, eliminating the need for miners and allowing users to mine and verify data on the blockchain just by holding and transacting. In order to prepare the cryptocurrency network for another bull run, we must develop network scalability in order to endure future developments of the ecosystem.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]

By Jacob Stelter

By Jacob Stelter