The crypto industry just concluded its annual conference (Bitcoin2024), held this year in Nashville, TN, where senator Cynthia Lummis (R-WY), and presidential candidates Bobby Kennedy Jr. and Donald Trump each spoke about easing banking restrictions on crypto companies, establishing and maintaining a strategic bitcoin reserve for the Federal Government, and creating a streamlined regulatory environment in the United States with the intention of making the United States the crypto capital of the world. The message was clear. The parties challenging the incumbency were making a commitment to the crypto industry and saw crypto as a major driver of future growth for the United States economy. You can read more about the conference in this article by Zero Hedge and this article by Lou Kerner, head of the Crypto Oracle Syndicate and a Sarson Funds strategic partner.

Global Adoption: Where are we?

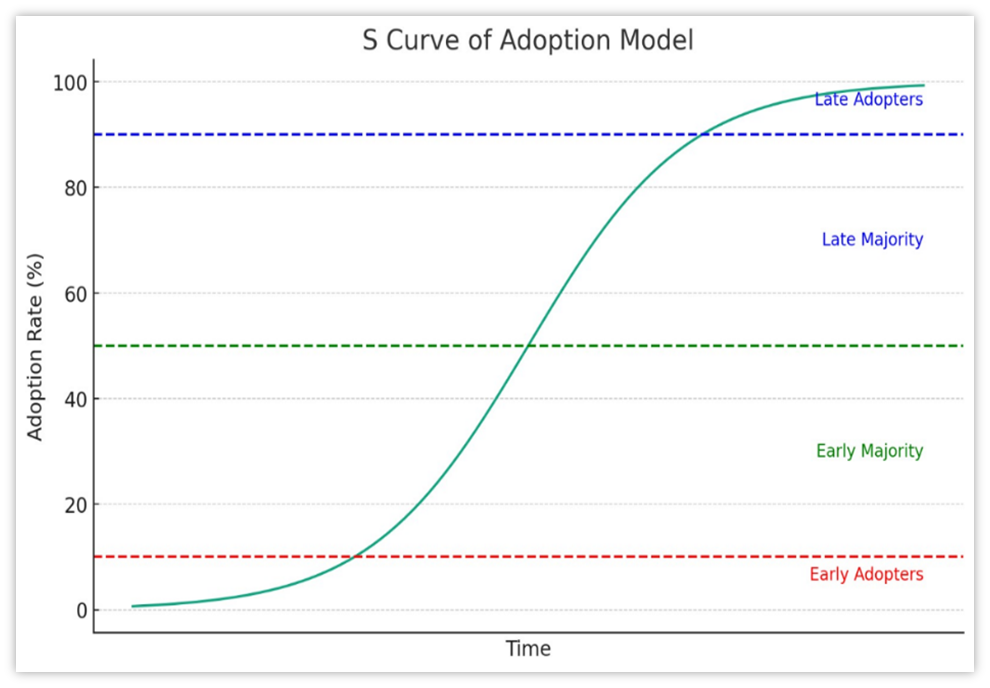

A recent study by Crypto.com estimates that 580 million people worldwide own cryptocurrency. The crypto industry’s year-over-year growth rate for 2023 is estimated to be 34%. This number gives us a jumping off point to do some critical thinking about where we may be in the crypto adoption “s-curve”. Technology adoption often follows an “s-curve” with predictable tipping points for major segments of consumers. This was the case with the telephone, the internet, cell phones, and computers. You can read more about s-curves and technological adoption trends at www.digital-adoption.com/.

Because we believe that at some point over the next 5 to 10 years, nearly all the internet and smartphone users worldwide will be transferring value and data utilizing blockchain technology, we theorize that the total amount of cryptocurrency users will eventually match the currently estimated 5.5 billion smartphone users. This gives us a sense that crypto as a new and enduring technology is around 10-12% of the way into its ultimate global adoption. As you can see from the graphic, it is right around this time that things start to get exciting.

Investment Strategy Focus: Small Coin Strategy

This strategy focuses on identifying and investing in disruptive early-stage crypto projects. With a team managed, top down, bottom-up approach to portfolio construction, the strategy seeks to identify best-of-breed projects. We are investing in emerging trends in web3, AI, RWAs (Real World Assets) gaming and DePIN (Decentralized infrastructure). We have a rigorous selection process in place to ensure that we capture the most promising opportunities while managing risk effectively. The Small Coin Strategy has been in existence for over 5 years and offers investors exposure to venture stage crypto projects that can’t be purchased on exchanges.

Portfolio Company Highlight: Credentialing Standards Institute (CSI)

Looking Forward:

As we quickly approach the presidential election, we are seeing a lot of reasons to keep capital invested in the cryptocurrency markets. The US elections will likely introduce volatility into crypto prices, creating buying opportunities, with a preference for Bitcoin over Ethereum for the rest of 2024. We anticipate a rally in Bitcoin’s price around the election, potentially pushing it near or above $100k by year-end. Additionally, Saudi Arabia, which recently chose not to renew a 50-year agreement with the US to trade oil exclusively in dollars, might consider using Bitcoin as part of its foreign currency strategy or may propose accepting Bitcoin to gain negotiation leverage over the US.

Disclosures: Not investment advice. The Author, Sarson Funds, Inc. and its affiliated managers may hold positions in the projects mentioned. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].