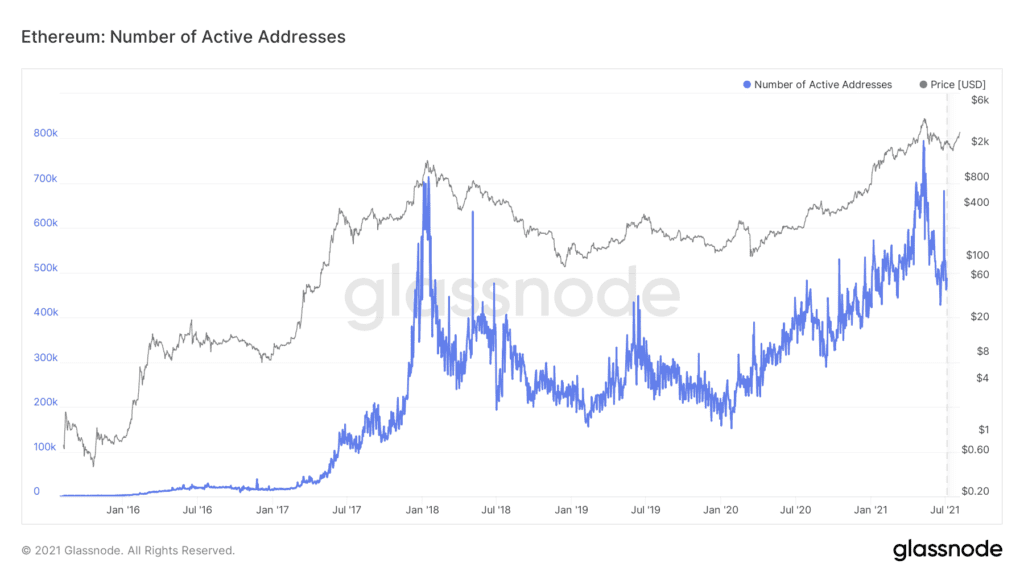

The “London” Hard Fork is now live on Ethereum’s network as of Block 12,965,000, minted around 8:34 AM EDT, August 5th, 2021. Importantly to investors, the upgrade implements changes to the platform that may have a profound impact on the future of our current crypto economy.

While the London upgrade implements five Ethereum Improvement Proposals (EIPs), EIP-1559 stands out. By introducing token burns, EIP-1559 changes Ether’s tokenomics by reducing long-term supply projections. Previously, 100% of transaction fees on Ethereum were allocated to miners as reward for processing and recording network transactions. With EIP-1559 implemented, however, there is now a base fee applied to network transactions. This base fee is burned, destroying the Ether and reducing its total supply.

Basic economics dictates that a reduction in supply or an increase in demand increases the price of an asset, given all else is held constant. Thus, tokenomics, which describes the supply and demand characteristics of a crypto token, is a core consideration for investors. Bitcoin’s tokenomics famously utilize a hard cap, meaning that the maximum supply of Bitcoin created could only ever reach 21 million. Digitally-verified scarcity like Bitcoin’s was never possible until the advent of blockchain technology; today, it is a driving narrative for decentralized stores of value.

The implementation of Ethereum’s EIP-1559 marks an important milestone for its position along the spectrum between inflationary and deflationary assets. Even though Ethereum still does not have a hard cap like Bitcoin, both of the assets are technically disinflationary in their current form—this is commonly misunderstood, as Bitcoin is often touted as being deflationary. In reality, Bitcoin is disinflationary. Disinflation occurs when the rate of inflation is decelerating. Current estimates put Bitcoin’s inflation rate between 1.5% – 2.0%; this will likely continue to decline as halvings continue to reduce the issuance rate of Bitcoin relative to its price.

Unlike Bitcoin, however, Ether’s supply may actually begin to decrease if token burns resulting from EIP-1559 begin outweighing new Ether issuance from miners. So long as Ether’s price holds steady or appreciates against a dwindling supply, Ether becomes truly deflationary. Ethereum 2.0 implementation could make such a deflationary scenario even more pronounced as Ether mining becomes obsolete and Ether issuance continues to decline. Moreover, Ethereum 2.0 scaling and continued network expansion will likely increase the rate of Ether-burning transactions. While some of Ethereum’s community continue to debate introducing a supply cap to Ether, both the current and upcoming deflationary mechanisms suggest that a cap may be unnecessary to perform as a store of value.

Ultrasound.money is a new website tracking Ether’s supply in the wake of EIP-1559. The site’s Q&A states, “Ultra sound money is an Ethereum meme focusing on the likely decrease of the ETH supply. If capped-supply gold is sound, decreasing-supply ether is ultra sound.” Clearly, this new narrative for Ethereum encroaches on Bitcoin’s “Gold 2.0” status as the ultimate digital store of value. The site also references Nikhil Shamapant’s (known on twitter as @SquishChaos) 77 page report on Ethereum entitled, “Ethereum, The Triple Halving”. In the report, Shamapant draws a parallel between Ethereum 2.0’s upcoming supply issuance reduction with previous Bitcoin halvings. More specifically, he equates a 90% reduction in issuance with 3 Bitcoin halvings. The implications this could pose for Ether’s price are hard to ignore.

Raoul Pal, CEO/publisher of The Global Macro Investor and CEO/co-founder of Real Vision Group recently spoke with YouTube channel Altcoin Daily on his recently written article, “The Greatest Trade in the World”, substantiating his decision to sell significant amounts of his Bitcoin for Ether. Acknowledging Ethereum 2.0’s inevitable staking unlock, Raoul states, “I think the unlock will probably lower the price. But between now and that unlock? Oh my god, this is one of the best setups I’ve ever seen. I think arguably better than Bitcoin in March 2020.”

Without doubt, Ethereum’s fundamental developments against the already blistering backdrop of the broader crypto space can make such speculations difficult to process. At Sarson Funds, we believe that thorough and unbiased analysis, disciplined portfolio management, and appropriate risk tolerance are necessary to maximize the value we create through digital asset investing. In pursuit of these goals, we welcome engagement from our readers. What do you think about Ethereum, EIP-1559, Ethereum 2.0, and the broader markets?

Follow us on Twitter, LinkedIn, and check out our newsroom.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]