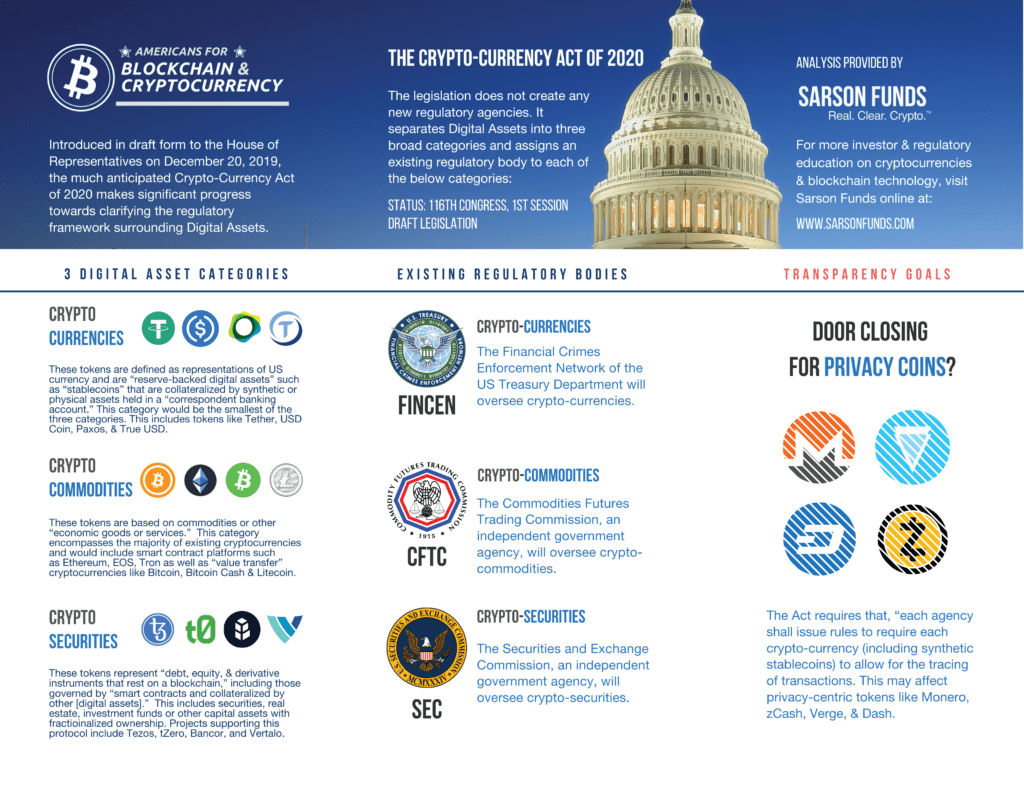

Introduced in draft form to the House of Representatives on Friday, December 20, 2019, the much anticipated Crypto-Currency Act of 2020 makes significant progress towards clarifying the regulatory framework surrounding Digital Assets.

You can read the entire bill here and find our analysis below.

Click here to download the Sarson Funds Crypto-Currency Act of 2020 Investor Infographic (above).

Crypto-Currency Act of 2020 Summary:

The legislation does not create any new regulatory agencies. It separates Digital Assets into three broad categories and assigns an existing regulatory body to each of the below categories:

Crypto-currencies: These tokens are defined as representations of US currency and are “reserve-backed digital assets” such as “stablecoins” that are collateralized by synthetic or physical assets held in a “correspondent banking account.” This category would be the smallest of the three categories.

Regulator: Financial Crimes Enforcement Network (FinCEN)

Coins Included: TrueUSD (TUSD), USD Tether (USDT), Paxos Standard, (PAX), USD Coin, (USDC)

Crypto-commodities: These tokens are based on commodities or other “economic goods or services.” This category encompasses the majority of existing cryptocurrencies and would include smart contract platforms such as Ethereum, EOS, Tron as well as “value transfer” cryptocurrencies like Bitcoin, Ripple’s XRP & Litecoin.

Regulator: Commodity Futures Trading Commission (CFTC)

Coins Included: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash

Crypto-securities: These tokens represent “debt, equity, & derivative instruments that rest on a blockchain,” including those governed by “smart contracts and collateralized by other [digital assets].” This includes securities, real estate, investment funds or other capital assets with fractioinalized ownership. Projects supporting this protocol include Tezos, tZero, Bancor, and Vertalo.

Regulator: Securities and Exchange Commission (SEC)

Coins Included: Tezos, tZero, Bancor, and Vertalo

A Rapidly Closing Door for Privacy Coins:

The Act requires that, “each agency shall issue rules to require each crypto-currency (including synthetic stablecoins) to allow for the tracing of transactions [emphasis added] in the crypto-currency and persons engaging in such transactions in a manner similar to that required of financial institutions with respect to currency transactions.”

Regulator: Financial Crimes Enforcement Network (FinCEN)

Top Coins Included: Monero, Zcash, Dash, Verge, Horizon

The proposed legislation is a welcomed move forward as it provides a protective framework for businesses and institutions seeking to grow their engagement with cryptocurrency technology. The Act’s final provision regarding “transaction traceability” provides long-awaited safeguards against money laundering and criminal financial activity – the enabling of which was a criticism that cryptocurrency proponents have heard from the likes of Bill Gates and Donald Trump and have long sought to shed. This requirement would bring the United States into cohesion with Europe’s FATF’s new“travel rule” which requires reporting on crypto transactions greater than $1000 and would effectively be a deathblow for privacy-centric cryptocurrencies in the United States.

Speaking on behalf of ourselves and other firms building businesses around cryptocurrencies, we applaud Representative Paul Gosar (R-AZ) and his team for the well written legislation. It is in line with recommendations that we have been offering since 2017 and that we believe are the foundation upon which crypto businesses in the United States will be built.

You can learn more about how regulation is shaping the adoption of Cryptocurrency by checking us out at www.sarsonfunds.com/education.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]