As August descends upon crypto investors, the never-ending negative news cycle that had become cryptocurrency’s theme song, has mercifully seen its volume turned down. So far “Regulation Summer” has lived up to the hype. Regulators in the US and abroad have introduced several pieces of crypto-focused legislation.

These are basic changes that need to happen before Wall Street will let their representatives recommend this (or any new) category of investments.

Most of the rules proposed have been expected and many market participants (including this author), are happy to see them.

Insider Trading and Price Manipulation can have no room in a market that is fair to all participants. Also, it would be helpful if “stablecoins”, the money markets of the crypto industry, stopped falling to zero and destroying the savings of their unlucky holders. If it takes a regulator and an auditor to make this happen then so be it.

When the history books are written, 2022 will likely be remembered best for its tragic geopolitical events or perhaps for America’s record setting headline inflation numbers, but those of us in the crypto markets, we will also remember the bankruptcies of several large firms.

The failure of Three Arrows Capital (a $10B Hedge Fund) and Terra Luna Foundation (a $40B dollar crypto project) caused enormous spillover effects on the which resulted in the collapse or near-collapse of major crypto lenders including Celsius Network (1.7 million customers), Voyager Digital (1 million customers) and BlockFi. Of those, only BlockFi remains out of bankruptcy at time of writing.

Watching the rapid collapse of so many institutions that were once thought unassailable has certainly brought counter-party risk into sharp focus for our investment team at Sarson Funds.

Where do we go from here?

We continue to believe that we are somewhere in the middle of another crypto winter and that the crypto market will “bounce along the bottom” as it has been doing with Bitcoin trading between $20,000-$25,000 until we get greater regulatory clarity from Washington D.C. or until another yet unknown catalyst brings large allocators back into the asset class with their investment dollars.

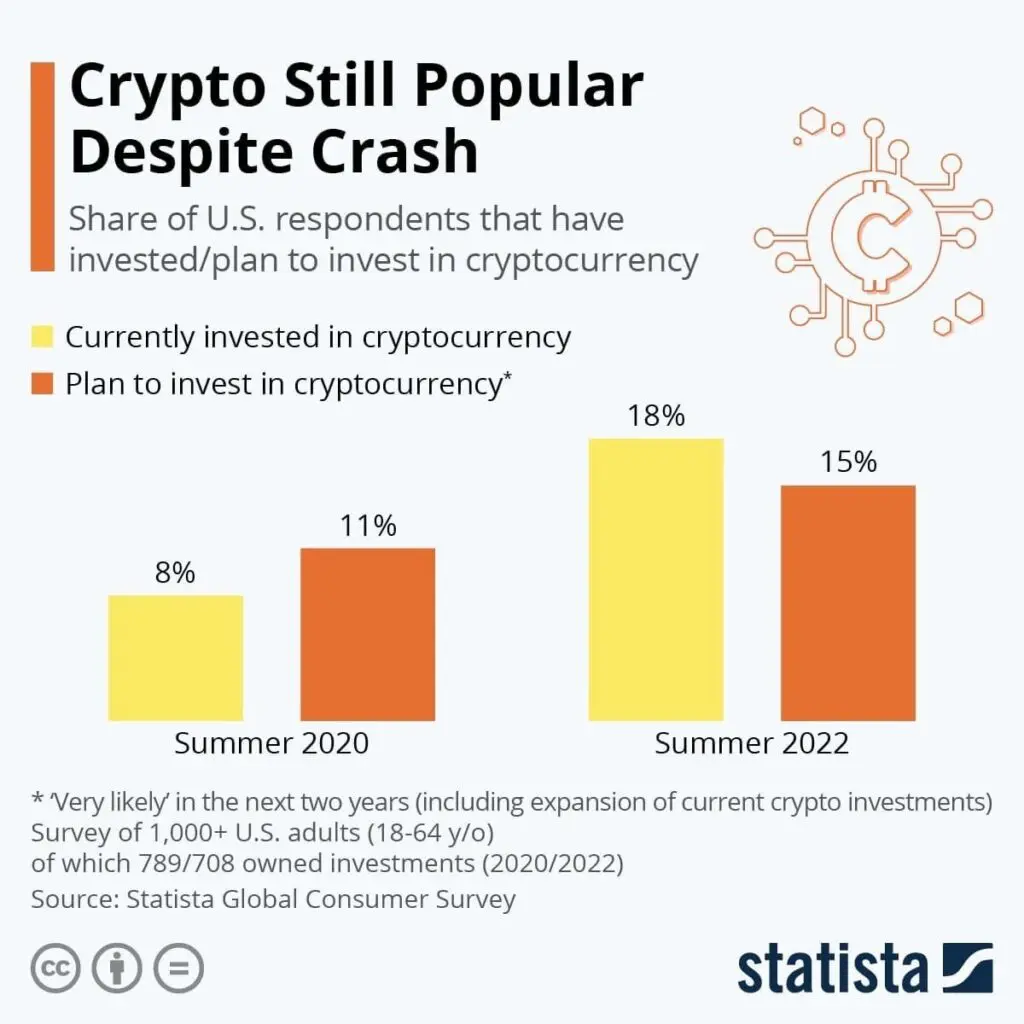

We do see reasons to be optimistic. Despite the weak market conditions, many large banks and investment houses (including Bank of America and BNP Paribas) continue to announce and deploy new digital asset market banking and service divisions. Retail sentiment is also encouraging. The below graphic shows retail interest in the asset class today easily exceeds 2020 bear market levels.

At Sarson Funds, we remain steadfast in our core belief that better, faster, and cheaper technology ultimately beats out older, slower, and more expensive technology. And at its most fundamental level, cryptocurrency and digital assets are exactly this. We have little doubt that blockchain technology and related cryptocurrency projects will one day be incorporated into future financial structures – although the timing and methods for such inclusion illicit widely differing opinions.

How are we positioned?

For those funds where we do have flexibility, we have been tactically reducing exposure by selling into strength. We are using the sideways markets to realign our portfolios to our highest conviction ideas and are making sure that we own the best projects in each industry vertical in which we expect to see disruption from the application of blockchain technology.

Without any major catalysts for the market on the calendar until Ethereum’s scheduled upgrade on Sept 19th, we believe we will continue in the current choppy market and that we find additional attractive entry points over the remainder of the summer. We have tactically increased the cash balances of our portfolios by up to as much as 25% to allow our managers to be opportunistic but with the intention of deploying all cash back into crypto by the end of September. Of course, as the facts change, so to do our opinions, so watch for updates from us again as more data provides us with additional clarity as to the best course of action for our portfolios.

With regards,

John Sarson, CEO

SARSON FUNDS

Real. Clear. Crypto.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]