Weekly Analyst Thoughts

Curve Pool

Defi recently welcomed a new development to its space: Curve Pool. Curve Pool brings together stablecoins and wrapped tokens and offers liquidity pools for investors to contribute to.

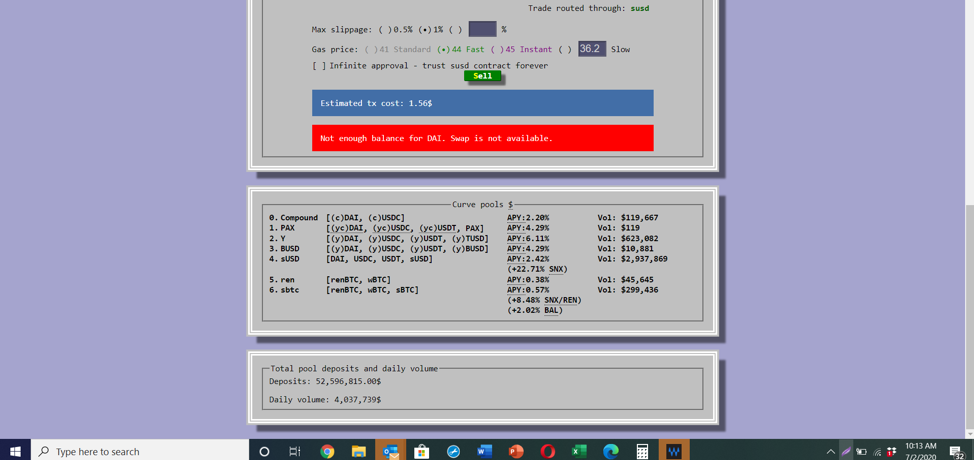

Below is a snapshot of their website and the potential returns (APY) investors can earn by joining their pools. Notice that Synthetix token (SNX) offers multiple rewards in SNX for providing liquidity to its stablecoin (sUSD) and its synthetic bitcoin (sBTC).

Source: https://www.curve.fi/

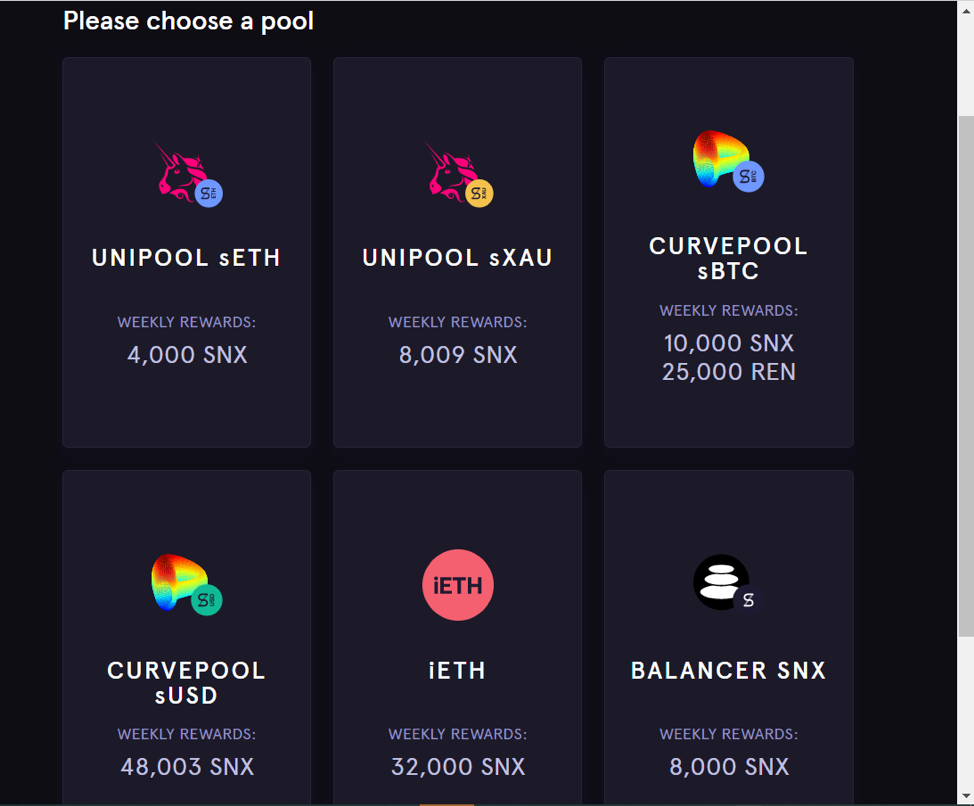

Synthetix app Mintr, pictured below, promotes opportunities to earn SNX with Curve pool.

Source: https://mintr.synthetix.io/

In summary, if you are holding SNX, REN or other stablecoins, but not using Curve pool to provide liquidity and earn interest on your holdings, then money is being left on the table. If this post sparks your interest in Curve pool, consider the sBTC pool (pool 6) because it gives investors exposure to multiple tokens as they could earn SNX, REN, BAL and CRV.

By Jacob Stelter

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]