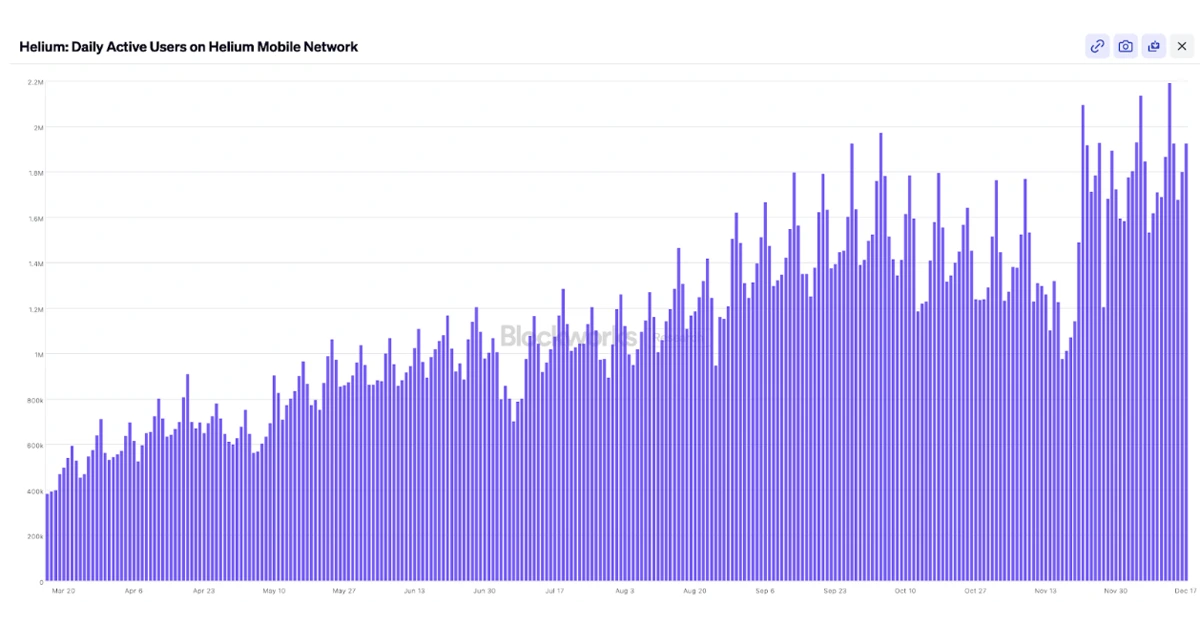

Helium’s network shows strong growth in user adoption and data usage, with subscribers exceeding 600,000 and daily active users nearing 2 million as of mid-December 2025. These Helium growth metrics suggest increasing real-world utility in decentralized telecom.

Key Points

-

-

Helium’s network shows strong growth in user adoption and data usage, with subscribers exceeding 600,000 and daily active users nearing 2 million as of mid-December 2025, suggesting increasing real-world utility in decentralized telecom.

-

Annualized revenue has climbed to around $20 million, driven by data credit burns outpacing token emissions, which could lead to deflationary pressure on HNT and support long-term value.

-

Partnerships with carriers like AT&T and expansions into markets such as Brazil highlight scalable potential, though challenges like coverage consistency and regulatory hurdles in new regions may influence pace.

-

The community-driven model reduces infrastructure costs compared to traditional telecom but relies on incentives that could vary with market conditions.

-

Network Performance Highlights

Helium’s transition to a fully revenue-burning model in mid-2025 has tied token utility directly to real-world demand. Daily Data Credit (DC) burns, pegged at $0.00001 per unit, have surged, reflecting increased data transfers. The mobile subnetwork dominates, accounting for nearly all burns, while IoT contributions remain minimal. Hotspot deployments continue steadily, with converted non-Helium hardware boosting totals to around 121,000, enhancing coverage without heavy capital outlay.

Economic Model and Token Dynamics

HNT’s role in burning for DCs creates a demand loop. More data usage requires more HNT purchases and burns. Recent halvings have reduced emissions to about 7.5 million HNT annually, while burns have pushed the supply into deflationary territory. This could amplify scarcity if usage trends persist, especially with grants funding targeted expansions.

Growth Drivers and Risks

Key catalysts include carrier offload programs, where legacy providers like T-Mobile and AT&T route traffic through Helium hotspots, offloading over 74 TB daily. International moves, such as into Brazil via partnerships, open vast markets. However, challenges like ensuring consistent service quality and navigating regional regulations could temper pace. Research suggests the community-driven approach mitigates some traditional telecom inefficiencies, such as high infrastructure costs.

Helium represents a paradigm shift in wireless connectivity, evolving from an IoT-focused experiment into a scalable, community-owned telecom alternative. As we deepen our investment in this network, it’s essential to understand not just the headline metrics but the underlying mechanics driving sustainable value. Migrated to Solana in 2023, Helium leverages decentralized incentives to crowdsource infrastructure, rewarding hotspot operators with HNT for providing coverage. This model has propelled impressive growth, particularly in its mobile segment, where affordable plans (starting at $0/month) blend community hotspots with fallback carrier networks like T-Mobile.

Consider the subscriber trajectory: from 461,500 at the end of Q3 2025 to over 602,400 by mid-December, marking a roughly 30 percent increase in under three months. This isn’t speculative hype; it’s tied to tangible utility. Daily active users have climbed to nearly 1.9 million, up from 1.2 million in Q3, with a 212,510 gain in just the last week alone. Such figures underscore a network that is not merely operational but increasingly integral to everyday connectivity for millions. Data transfer volumes tell a similar story. Daily paid traffic has risen to 74.44 TB, a 9 percent weekly uptick, pushing cumulative offloaded data well beyond the 5,452 TB reported in Q3.

Economics of Usage

Helium’s revenue model stands out for its direct linkage to usage. Annualized revenue hit $18.3 million in Q3 and escalated to around $20 million by November, fueled by a policy to burn 100 percent of subscriber revenue into DCs. This creates a virtuous cycle. Higher usage demands more HNT burns, which reduces circulating supply, while emissions halve every two years. The most recent halving occurred in August 2025. Recent data shows burns outpacing emissions, flipping HNT from inflationary earlier in the year to deflationary. Over 4.5 million HNT, about 2 percent of total supply, has been burned, with monthly rates at 0.15 percent. If carrier data growth sustains its 500 percent annual pace, this deflation could intensify, potentially driving HNT’s value higher as scarcity meets rising demand.

Organic Expansion Model

A less-discussed aspect is the organic, human-centric pattern of network expansion. IoT coverage maps reveal dense clusters in urban centers, ports, and coasts, driven not by centralized planning but by individuals deploying where needs are acute. This bottom-up approach minimizes waste, as operators naturally prioritize high-demand areas for rewards. Similarly, mobile hotspots have grown to 120,925, with 264 added weekly, including conversions from existing Wi-Fi routers via Helium Plus. This lowers entry barriers for businesses like cafes or hotels, integrating seamlessly with equipment from manufacturers such as Ubiquiti or Cisco.

Partnerships and Global Moves

Partnerships amplify this momentum. Collaborations with AT&T for demand sampling, where new hotspots initially handle free traffic to identify optimal paid offload spots, streamline scaling. In Mexico, ties with Telefónica’s Movistar and deployment specialist LongFi target underserved regions like Oaxaca. The recent Brazil entry via Mambo WiFi, leveraging 40,000 access points, positions Helium to tap millions more users in South America. These moves highlight a key insight: Helium is not competing head-on with telecom giants but complementing them. It offloads traffic to reduce their capital expenditures while earning through DCs.

Helium’s strength lies in its flywheel effect, often underappreciated in analyses. More hotspots expand coverage, which attracts subscribers and carriers. That growth boosts data volume and revenue, leading to greater HNT burns and incentives for further deployments. This self-reinforcing loop has turned Helium into Solana’s top DePIN protocol by revenue, up 787 percent year over year. Unlike hype-driven projects, this progress is grounded in real-world adoption. Seven carriers are now integrated, and consistent Saturday traffic peaks suggest consumer reliance.

To quantify progress, here’s a table of key metrics evolution:

| Metric | Q3 2025 End | Mid-Dec 2025 | QoQ/Recent Change |

| Subscribers | 461,500 | 602,402 | 35% |

| Daily Active Users | 1.2M | 1.92M | 60% |

| Daily Data Transfer (TB) | 32.4 | 74.44 | 129.80% |

| Mobile Hotspots | 33,710 | 120,925 | 258.60% |

| Annualized Revenue ($M) | 18.3 | ~20 | 9.30% |

| HNT Burns (Cumulative) | ~$6.2M in DCs | 4.5M HNT | 2% of supply |

Another table comparing Helium to traditional telecom benchmarks:

| Aspect | Traditional Telecom | Helium Model |

| Infrastructure Cost | High (billions for towers) | Low (crowdsourced hotspots) |

| Expansion Speed | Slow, regulated | Rapid, incentive-driven |

| User Acquisition | Marketing-heavy | Organic via rewards/affordability |

| Revenue Accrual | Centralized equity | Token burns, decentralized |

| Global Scalability | Region-locked | Borderless, with grants aiding entry |

Grant Program and Risks

One overlooked element is the grant program’s impact. One million dollars has been funded so far from a $50 million commitment, enabling targeted builds without waiting on carriers. This proactive stance could accelerate adoption in emerging markets where traditional infrastructure lags. However, risks persist with service variability in sparse areas, potential regulatory hurdles in new regions, and competition from other DePINs. Still, Helium’s deflationary pivot and usage-led economics position it as a resilient bet.

Community sentiment, from founders like Amir Haleem emphasizing transparency in token management (such as the 5.7 million HNT buyback) to analysts highlighting undervaluation, reinforces this. The market cap is down 81 percent year over year despite a revenue boom. HIP 147’s “Mobile Data Eats First” reallocates up to 60 percent of emissions to data rewards, prioritizing utility over proof-of-coverage gaming. As one observer noted, this is not just numbers. It’s proof that DePIN works when solving real problems.

Price Decline Amid Progress

Helium’s HNT token reached an all-time high of about $55 in November 2021 but has since fallen to roughly $1.60 by December 2025. This stark contrast exists even as the network has achieved milestones like launching a nationwide 5G infrastructure, establishing Helium Mobile as an MVNO, securing partnerships with major carriers such as AT&T and Telefónica, and scaling to over 600,000 subscribers with nearly 2 million daily active users. These developments highlight a disconnect between token valuation and operational success, likely influenced by market sentiment rather than fundamentals.

Future Outlook

Looking ahead, the ongoing deflationary tokenomics—where data credit burns now exceed emissions—could drive scarcity and value accrual as network usage expands. With annualized revenue approaching $20 million and international growth into markets like Brazil, continued metric improvements may align price with utility and position HNT for recovery in a maturing DePIN sector.

The data supports a telecom model built on participant ownership rather than corporate centralization. With deflationary token mechanics, growing user adoption, and an expanding global footprint, Helium exemplifies how DePIN can bridge digital infrastructure gaps while creating aligned incentives. Market inefficiencies may persist, but the trajectory points to long-term relevance.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.