Ethereum Revenue Decline: The Impact of the Dencun Upgrade

Ethereum (ETH), a leading cryptocurrency, has experienced a significant revenue decline since the March 2024 Dencun upgrade. This drop has stirred concerns among investors and developers, but it’s important to understand that this trend reflects a pivotal transformation in Ethereum’s network.

The Dencun Upgrade: A Major Shift for Ethereum

On March 13, 2024, Ethereum introduced the Dencun upgrade, a substantial overhaul aimed at boosting scalability, lowering transaction fees, and enhancing security. This upgrade, incorporating nine Ethereum Improvement Proposals (EIPs), is one of the most significant changes since the Merge in September 2022.

At the heart of this upgrade is EIP-4844, which brings proto-danksharding to Ethereum. Proto-danksharding enables the network to manage higher transaction volumes through Layer-2 (L2) solutions, significantly reducing gas fees. Although this is a positive development for users, it has led to a notable decline in Ethereum’s revenue.

Impact of the Dencun Upgrade on Ethereum’s Revenue

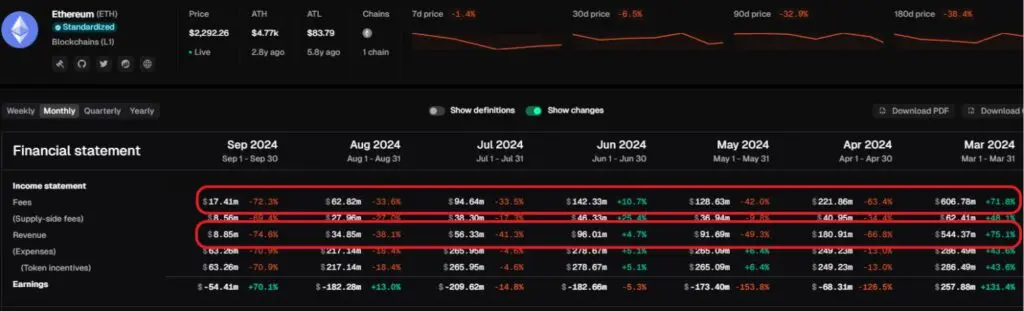

Since the Dencun upgrade, Ethereum’s revenue has plummeted from $544.37 million in March to just $1.80 million in September—a staggering 99.7% decrease. This dramatic drop is a direct result of the reduced gas fees implemented by the upgrade.

Before the Dencun upgrade, gas fees were a major source of revenue for Ethereum, especially from L2 networks. The introduction of blobs, a new type of temporary data, has streamlined the process of transferring data from L2 to the main chain. Consequently, the cost of storing data, which previously contributed to over 90% of L2 rollup users’ fees, has sharply decreased.

Long-Term Benefits of the Dencun Upgrade

While the immediate revenue drop may be alarming, it’s essential to view it within the context of Ethereum’s long-term strategy. By reducing gas fees, Ethereum is becoming more appealing to developers and users, particularly those using L2 solutions like Optimism, Arbitrum, and Base.

Lower transaction costs are likely to increase network usage, driving higher adoption of Ethereum-based applications. This could lead to a larger, more active user base, ultimately benefiting the Ethereum ecosystem. Additionally, as Ethereum approaches full danksharding—part of its post-Merge phase known as “The Surge”—its ability to handle higher transaction volumes will improve, potentially leading to a revenue rebound.

Enhancements in Security and Cross-Chain Communication

The Dencun upgrade also brings important security improvements through EIP-4788 and EIP-6780. These enhancements fortify the communication between Ethereum’s consensus and execution layers and make smart contracts more resilient against attacks. Such improvements are crucial for maintaining Ethereum’s network integrity.

Moreover, EIP-4788 advances cross-chain communication, making interactions between Ethereum’s main blockchain and L2 solutions more secure and efficient. This progress could further incentivize developers to build on Ethereum, knowing that the network offers both scalability and robust security.

Conclusion

The revenue decline following Ethereum’s Dencun upgrade is a consequence of its ambitious scaling and improvement plans. While this drop may seem troubling short-term, it signals a strategic shift towards a more scalable and user-friendly network. The Dencun upgrade is a crucial step towards Ethereum’s long-term success, positioning the network for increased adoption and usage.

Investors and developers should view this revenue decline as a temporary phase in Ethereum’s evolution. As the network continues to develop, the benefits of the Dencun upgrade will become more evident, supporting a sustainable and thriving Ethereum ecosystem.

Disclosures: Not investment advice. The Author, Sarson Funds, Inc. and its affiliated managers may hold positions in the projects mentioned. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].