As the cryptocurrency landscape matures, investors are looking beyond established assets like Bitcoin, increasingly seeking diversified exposure to innovative, high-growth opportunities. Small-cap cryptocurrencies present an exciting alternative, driven by unique use cases and breakthrough projects. Through the Small Coin Strategy (Fifth Khagan, LP) it aims to seize this opportunity—offering investors access to high-potential blockchain projects while prioritizing robust risk management practices to navigate this dynamic market.

The Opportunity in Small-Cap Crypto Investments

While Bitcoin has firmly established itself as a global digital store of value, small-cap cryptocurrencies are gaining attention for their potential to deliver substantial returns. Unlike Bitcoin, primarily valued as a decentralized currency and an inflation hedge, small-cap projects often represent early-stage innovations in areas like decentralized finance (DeFi), Web3, and Decentralized Physical Infrastructure Networks (DePIN). These emerging projects remain under the radar, offering higher volatility but significant reward potential as they continue to innovate and scale.

Small Coin Strategy: A Diversified Approach

The Small Coin Strategy, Fifth Khagan, LP, strategically allocates capital across 40-60 small-cap cryptocurrencies and blockchain technology enterprises. The strategy adheres to a disciplined portfolio construction approach, investing 65% in publicly traded cryptocurrencies and 35% in off-exchange investments, such as Initial Coin Offerings (ICOs) and Private Placements. By diversifying across a wide range of small-cap assets, the strategy aims to capture opportunities in various sectors within the crypto ecosystem while balancing risk exposure.

Performance and the Appeal of Small-Cap Crypto

As of September 30, 2024, based on estimated internally calculated figures, The Small Coin Strategy (Fifth Khagan, LP) has achieved an estimated 90.0% return since inception of July 2018, a figure that starkly contrasts with the -56.0% decline in the 100 Small-Cap Crypto Index over the same period. This outperformance reflects the expertise in selecting projects with long-term viability and growth potential. The strategies multi-trader, rules-based portfolio construction process has been instrumental in navigating the volatility of small-cap markets.

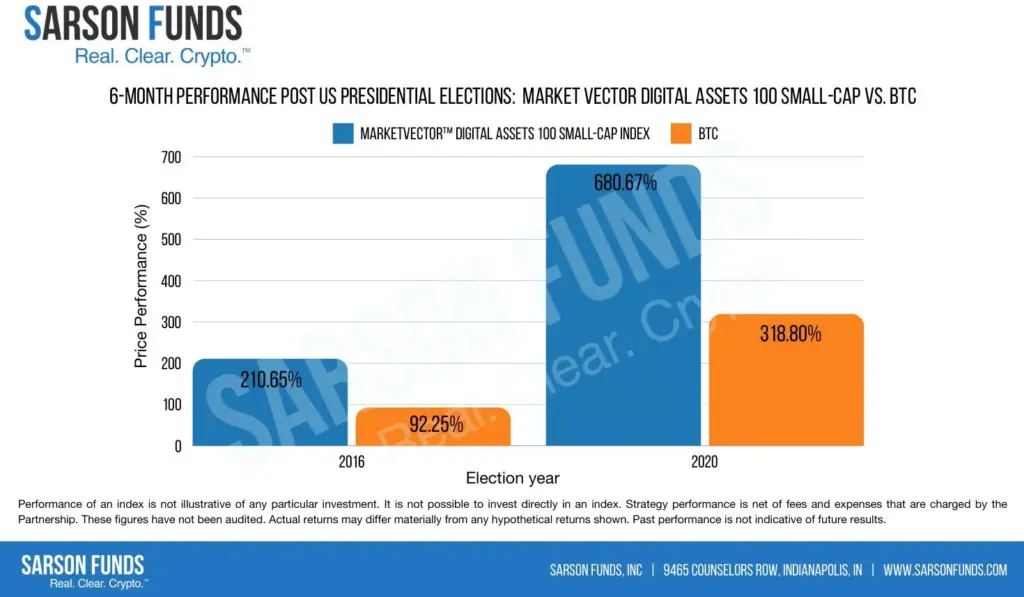

Small-cap assets, though more volatile, offer an appealing option for investors looking to diversify beyond Bitcoin and other high-market-cap coins. By holding a selection of small-cap assets, investors can access high-growth sectors within the crypto market that are often overlooked by larger, more established cryptocurrencies.

Bitcoin vs. Small-Cap Cryptocurrencies: Complementary Roles in a Portfolio

Bitcoin’s established role as a hedge against inflation and store of value makes it a cornerstone of many crypto portfolios. Yet, small-cap cryptocurrencies present a distinct opportunity: they enable investors to engage with cutting-edge blockchain applications and emerging technologies that have the potential to transform various industries. The Small Coin Strategy complements Bitcoin by offering exposure to these high-growth, innovative assets, creating a more diversified approach to crypto investing.

While Bitcoin is viewed as “digital gold” or a safe haven during uncertain times, small-cap cryptocurrencies are more akin to venture-style investments, with returns driven by technological advancements and specialized applications. This balanced strategy allows investors to benefit from both stability (through Bitcoin) and high-growth potential (through small caps) in the evolving crypto market.

Risk Management and Investor Protection

Recognizing the volatility of small-cap cryptocurrencies, the Small Coin Strategy prioritizes robust risk management. This approach includes rigorous security analysis, position size limits, and counterparty diversification, all designed to protect investors’ capital. Additionally, an extensive network of blockchain analysts and cryptocurrency insiders provides critical insights, enabling traders to identify emerging projects and make well-informed investment decisions.

Who Can Invest in the Small Coin Strategy?

The Small Coin Strategy is available exclusively to accredited investors, with a minimum investment requirement of $50,000 and a 90-day lock-up period, along with daily subscription options. Designed for those seeking exposure to high-potential small-cap projects, this strategy combines a structured approach, risk management, and a dedicated research network to support informed decisions.

Conclusion: Diversifying with Bitcoin and Small Caps

For investors seeking to balance the stability of Bitcoin with the growth potential of small-cap cryptocurrencies, the Small Coin Strategy offers a compelling solution. This approach not only diversifies across multiple blockchain sectors but also carefully manages the unique risks of small-cap investments. By combining Bitcoin’s established role as a store of value with the innovative potential of small-cap assets, investors can benefit from a portfolio that captures both foundational stability and emerging growth opportunities in the crypto market.

Disclosures: Sarson Funds, Inc. is a third-party marketing company and does not directly manage assets or provide investment advice. This information is for educational purposes only and is not intended as investment advice. It is recommended to consult a professional financial advisor before making any investment decisions. Past performance does not indicate future results. The opinions expressed here are solely those of the authors. Therefore, please consult with an investment advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].