Since inception, Ethereum has courted the attention of large companies. At the enterprise-level, no blockchain protocol offers the robust maturity and prospects of Ethereum-powered smart contracts.

However, as CoinDesk reports, it wasn’t until 2017 that a formal large-scale corporate consortium around Ethereum came into fruition: the Enterprise Ethereum Alliance (EEA).

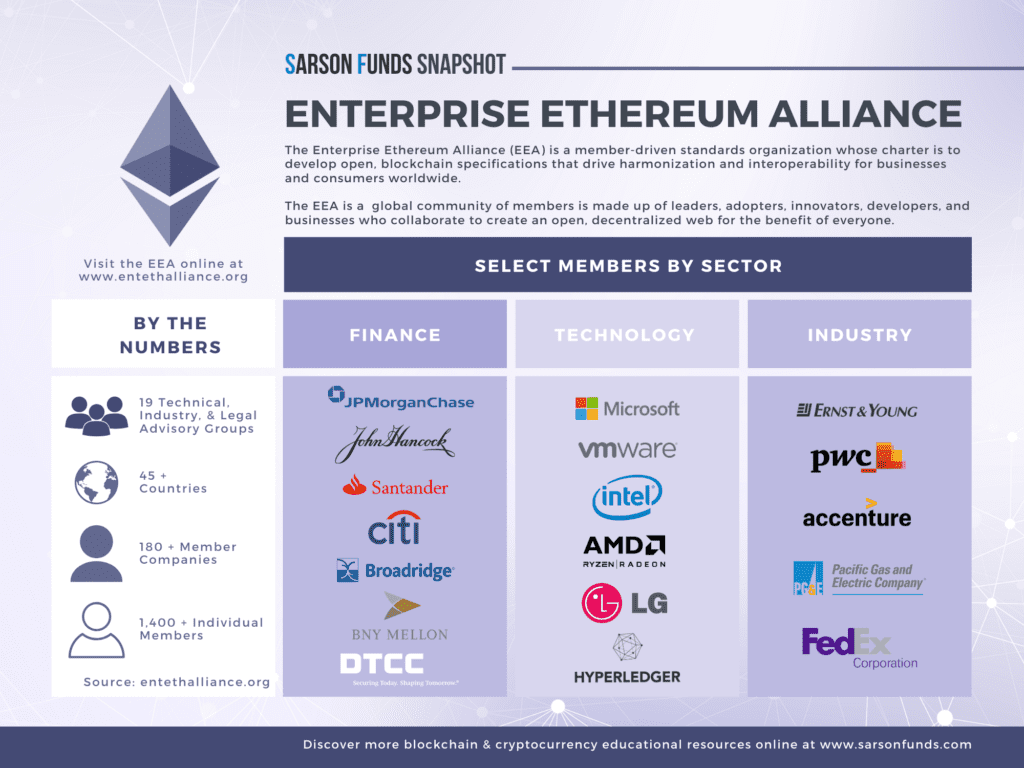

Sarson Funds has long covered the EEA and the powerful firms coordinating Ethereum best-practices across a diverse set of sectors. With market giants such as JP Morgan, Microsoft, Santander, E&Y, Citi and more, the EEA created a concerted effort to get large corporates and tech providers on the same page when implementing private (or “permissioned”) versions of Ethereum technology.

Thereafter, the EEA became a kind of standards organization for blockchain business, with an eye on a future state when the public blockchain might join with private implementations.

Check out the Sarson Funds Snapshot on the Enterprise Ethereum Alliance below.

You can read CoinDesk’s full article, written by Ian Allison, here.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]