By: John Sarson, CEO of Sarson Funds & Evan LaMontagne, Portfolio Manager

Introduction: Our Take on Solana DEX Jupiter as an Institutional Token

In the ever-evolving world of crypto, it’s easy to get lost in the sea of tokens, DEXs, and blockchain technologies. Yet, every so often, a gem surfaces that captures our collective attention, and today, that gem is Solana’s decentralized exchange (DEX) aggregator, Jupiter. As we peel back the layers, it becomes increasingly clear that Jupiter is not just another cog in the crypto machine. Rather, it has the hallmarks of an institutional token, and we believe it’s significantly undervalued. Join us as we delve into the heart of Solana DEX Jupiter, exploring its potential, its promise, and why we believe the JUP token is poised for notable price action in the future.

A Brief History of a 3-Week-Old Token

The Jupiter token made its public debut on January 31st through an initial coin launch and an “airdrop” of 10% of total tokens to its users and another 3.5 % to early investors and the project’s developers. Through this initial airdrop, the $JUP token made its entrance at $0.41 before swiftly climbing to $0.72 and then finding an equilibrium price in the $0.50 cents range, where it currently trades.

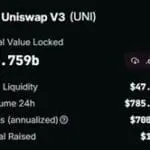

Comparing Jupiter and Uniswap

We have watched the initial price performance and while comparing the token to its most similar competitor token that’s already trading: Uniswap (UNI) (the largest decentralized exchange on Ethereum.) We believe that Jupiter is a far more attractive prospect than Uniswap for several reasons. Solana is a non-evm blockchain, meaning it is essentially sectioned off from the rest of the blockchain ecosystems that are powered by Ethereum. This leads to a potentially larger piece of the pie as a primary means of exchange on Solana. Currently Jupiter is accounting for more than 100,000 daily active traders on their platform, alongside hundreds of millions in volume, compared to Uniswap’s 1.4 billion in volume (across multiple chains), there is still plenty of ground to be gained yet, and huge potential for growth. We have also provided points listed below as reasons we believe Jupiter is potentially more valuable than Uniswap:

-

Ecosystem:

The Solana Ecosystem has been showing increasing trade volume, and higher growth rates than the Ethereum Ecosystem over the last 6 months.

-

Competition:

Dozens of DEX platforms have been launched on Ethereum, each a new competitor to Uniswap and a threat to its dominance. There are far fewer competitors taking on Jupiter, as it is the primary DEX aggregator on Solana, and a cornerstone in the on-chain Solana ecosystem.

-

Utility:

UNI tokens have limited utility as a governance token, JUP tokens, on the other hand offers governance while rewarding participation in the form of airdrops from new projects entering the Solana ecosystem through the Jupiter launch pad, and $JUP rewards for participating in voting.

-

Better Technology:

As we wait for promised upgrades in Uniswap’s capabilities with their coming launch of Uniswap v4, traders on Jupiter already enjoy advanced trading capabilities such as limit orders and conditional trading tools while taking advantage of Solana’s marginal fees.

As we look forward to potential price action in $JUP, we’re keeping our eyes peeled for several key catalysts. These factors could spell significant growth for the token, and ultimately, offer financial opportunities for investors.

Potential as an Institutional Token

We believe that the future is bright for Solana DEX Jupiter and the $JUP token. The quality of the project, coupled with its high trading volume, makes a listing on major platforms such as Coinbase all but assured. Such a development would not only increase the token’s visibility but also provide a direct pathway to institutional investors. While institutional ownership is currently high on Uniswap, (perhaps because of its availability on Coinbase?), institutional ownership is very low for Jupiter. We expect that as institutions do their homework and become more familiar with Jupiter, they will view JUP in the same way they view UNI: as core infrastructure components of their respective layer 1 blockchain. Jupiter is a blue chip for crypto, we believe at Sarson Funds that is what institutional investors are looking for.

All these factors combine to paint a picture of a token that is not just undervalued but primed for significant growth.

Looking Ahead: Jupiter Headed to a $1.00 and Beyond

Even though Solana’s DEX Jupiter (JUP) has not been explicitly labeled as an institutional token, the signs are all there. Its large market capitalization and trading volumes, coupled with Jupiter’s important role in the Solana ecosystem coupled with broad community support, all point towards its potential to attract institutional investors. In the current market, where institutional interest in cryptocurrencies, and specifically in the Solana ecosystem, is burgeoning, we believe that Jupiter is deniably appealing to big players and should see its price rise not just by the 50% required to rival the market cap of Uniswap but likely by more to reflect Jupiter’s role as the premier exchange center in crypto.

Disclosures: Not investment advice. The Author, Sarson Funds, Inc. and its affiliated managers may hold positions in the projects mentioned.

Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].