Weekly Analyst Thoughts

Involvement in the decentralized finance (Defi) space carries the risk of loss through hacks and flash loan attacks. Since these sophisticated flash loan attacks began in March 2020, users have been more reluctant to provide liquidity to Defi platforms that have not undergone a security audit by an independent third party.

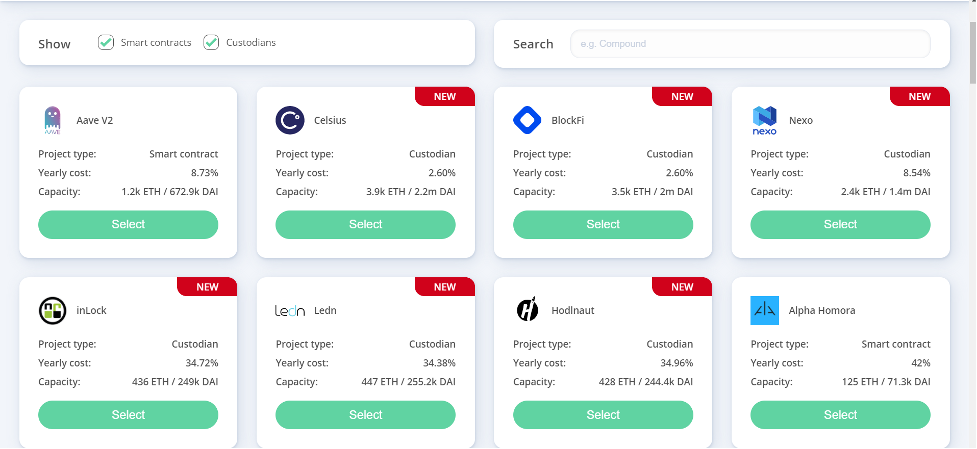

Users rely on audits for Defi platforms to protect their funds, while some take their asset protection further with incorporating decentralized smart contract insurance on Nexus Mutual. Users who want to buy smart contract insurance for decentralized platforms like Curve and Balancer can purchase a 1-year insurance plan for 2.6% of their assets staked on the Defi platform. Additionally, Nexus Mutual recently integrated insurance for centralized (Cefi) custodians like Celsius and Blockfi that protects users from withdrawal restrictions and hacking risk commonly seen on centralized crypto platforms. Below, see the insurance offerings of Nexus:

Source: https://app.nexusmutual.io/cover/buy/select-project

Although users can do their due diligence before investing with Defi and Cefi platforms, hacks do occur and one of the best ways users can protect themselves is by purchasing decentralized insurance coverage on Nexus Mutual.

By Jacob Stelter

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at info@sarsonfunds.com