In the next segment of Sarson Funds’ Defi Series, we will provide an overview and analytical discussion of Fantom (FTM), an alternative layer 1 decentralized financial (DeFi) network. Founded in 2018 by famous computer programmer Dr. Ahn Byung Ik, the original goal of the network was to create a blockchain that was both sustainable and scalable. When engineering this network, Ahn took a different approach, choosing instead to engineer a Directed Acyclic Graph (DAG), which differs from traditional blockchain networks but acts as if it were. With Fantom, Ahn created a DAG-based smart contract platform that takes a more sustainable and efficient approach to decentralized finance than many of its blockchain competitors. Fantom is EVM compatible, meaning that developers can deploy Ethereum smart contracts on the infrastructure of the Fantom network. In this article we will be discussing topics like directed acyclic graphs, time-to-finality, proof-of-stake, crypto cities, environmental benefits, along with some potential downfalls of Fantom’s network.

DAG

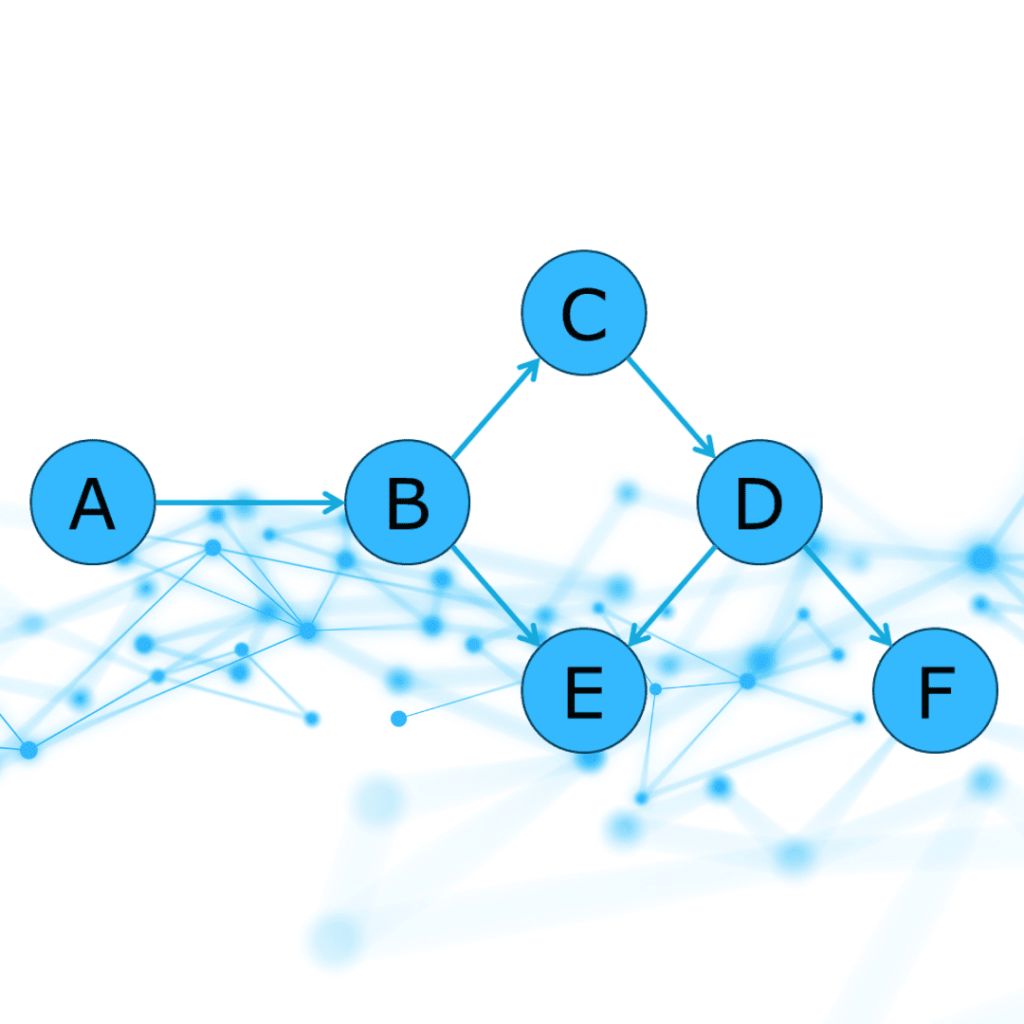

Directed acyclic graphs act similarly to traditional blockchains. Distancing themselves from traditional blockchain networks that use a chain of data blocks to hold transactions, DAGs hold transactions on vertices and edges on a ‘graph’ instead of a chain. See a brief example of DAG construction below:

Chart credit: CapGemini

DAGs allow for the network to be highly scalable, addressing the efficiency problems so many other distributed ledger technologies (DLTs) face. Problems occur in traditional blockchain networks from network growth overlapping with the transaction speed and block constraints, resulting in congestion. DAGs pose a potential solution to the scalability issue of alternative blockchains. DAG networks have the ability to scale with ease because they allow for transactions to be validated simultaneously. DAG technologies can handle hundreds of thousands TPS, up to theoretically 300,000 TPS for the Fantom network alone. This graphing technology handles high transaction speed while effectively maintaining security, which we will discuss later. Overall, Fantom’s DAG infrastructure has helped serve the network’s goals thus far in achieving a scalable and sustainable application of distributed ledger technology.

Speed

As mentioned previously, a goal for the pioneers of this technology was to create a network that is remarkably fast. The theoretical framework of 300,000 TPS remains a visible goal, but what separates Fantom from most of its competitors is it’s time-to-finality. Fantom’s time-to-finality for each transaction is between one and two seconds. This transaction settlement time coupled with Fantom’s high TPS puts this network in the argument for fastest distributed ledger technology in existence.

Security

Fantom’s scalability is complemented by industry-leading security. Fantom uses its proof-of-stake consensus as a way to achieve its network security. Fantom’s proof-of-stake consensus works so effectively because of its unique approach to transaction validation. Each transaction is spread randomly across Fantom validator nodes, allowing for no overlap in transactions and ensuring a secure ecosystem. Randomized distribution of transactions is unique and effective but is not the only way Fantom monitors security. The network follows a zero tolerance policy, meaning if a validator causes an error in verification, that validator then loses participation privileges and has their share of delegated FTM (Fantom’s native cryptocurrency) slashed. The disincentive to act maliciously deters nefarious node behavior due to the high minimum delegation of FTM required from users to be a validator. The minimum validator delegation is 1,000,000 FTM, which is equivalent to around $900,000 at today’s prices. To say the least, it is in no validator’s interest to act maliciously, as bad-action will risk loss of massive sums of money. To put this into perspective, Avalanche, the industry leader in time-to-finality, has no consequences for malicious behavior, an important thing to remember when evaluating the two close competitors.

Another part of the network that promotes security is Fantom’s methodology of on-chain governance. On-chain governance is a way for the Fantom community to make suggested improvements for which the network of FTM holders to vote. This provides a way for the network to improve for the liking of the user, while also allowing ideas in contention to be filtered out via consensus. Voting on governance proposals costs 1 FTM, while network proposals cost 100 FTM. Further, only stakeholders have permission to introduce a proposal. With these security conditions, Fantom further ensures network reliability while also accommodating for the greater needs of its users.

Energy

Not only is the Fantom network fast and secure, but it is also exceptionally sustainable compared to other distributed ledger technologies. Fantom’s energy usage is merely fractional when compared to the most prominent blockchains today, clocking in at 0.000024-0.000028 kWh per transaction. To put this into perspective, Bitcoin’s energy used per transaction is 2,264.93 kWh, and Etherum’s is 238.22 kWh. DAGs allow for the network to operate with uncommonly small energy consumption, even when working at speeds as fast as it does. Fantoms energy usage is so small that it compares to turning on a 100w light bulb once for one second. In comparison, the global US banking industry alone uses 263,720,000,000 kWh per year, while Bitcoin uses 102,370,000,000 a year. Fantom only uses 8200 kWh per year, less than the yearly average of a single US home. As the topic of energy consumption is tied with ongoing concerns of blockchain CO2 emissions with global entities considering the adoption of crypto, network sustainability is essential.

Smart Cities

The Fantom network also creates potential for crypto-based smart cities. Smart cities are cities of the future that are constructed in a way to maximize operational efficiency. As time becomes more valuable, and data becomes more of a solution to everyday problems, a technology that can save you time and keep your data secure is essential. This is where the Fantom network could provide value for smart city infrastructure. In the case of future smart cities, Fantom could provide the architecture to fix everyday problems like power outages by executing smart contracts that immediately sense and notify service providers instantly with near zero cost. Fantom could even help fix traffic by ensuring the constant interconnection and communication of autonomous vehicles at lightning speed and minimal energy costs. In the event that future smart cities depend on the Fantom network, the Fantom DAG has the theoretical technical ability to store massive amounts of data and use it to provide further solutions to problematic inefficiencies cities face today. From a broader perspective, Fantom could act as the foundation layer that makes every part of cities interconnected, ensuring trustless operational unity, saving money and time for everyone.

Centralization

While the technological makeup of the Fantom network seems impenetrable, some aspects do still pose concern. One concern for the Fantom network is its number of validators. Due to the high initial FTM delegation for validators, there are 58 current validators as of 2/20/2022. While the network is still relatively secure, centralization of Fantom validators is one troubling attribute that poses significant risks for its reliability, as seen by several recent network outages on the similarly-centralized Solana blockchain. The whole intent around cryptocurrencies and blockchain technology is for networks to be as decentralized as possible to ensure trustless operational contingency regardless of geopolitical interference, and with 58 validators in the network, centralization risks pose existential threats to the network. Another troubling aspect stemming from centralization is Fantoms “Nakomoto coefficient”. The Nakamoto coefficient is the minimum number of validators that can collude to shutdown a network. The Fantom network’s Nokomoto coefficient is three, meaning that the fate of the network can potentially be decided by 3 nodes in the chance they collude. This alarming reality poses extreme threats for the trust of the network and stems from its high delegated stake required in order to validate.

Concluding Remarks

As new technologies and solutions for financial freedom and democracy emerge, it is important to recognize the entire scope of benefits and detractors. Fantom has proven itself as a truly unique network that fulfills the needs and demands of traditional blockchains but through a DAG. As the crypto ecosystem unfolds, Fantom’s approach to the blockchain trilemma stands as a role model for emerging crypto projects and we are excited to see what is in store for the future. For more analysis on decentralized finance, stay tuned for the next chapters of the Sarson Funds DeFi Series, where we will discuss the most prevalent additions to the crypto ecosystem.

By Colm McDonald

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]