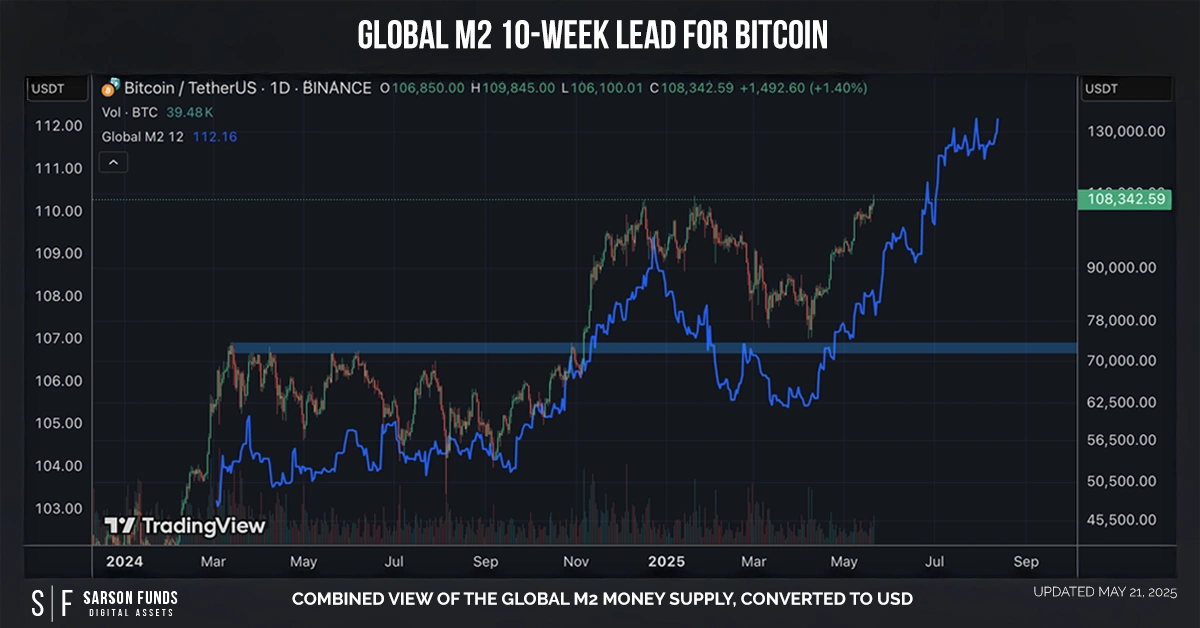

Originally published on August 30, 2024, this article has been updated to reflect recent trends in M2 money supply and Bitcoin price movements. With liquidity conditions shifting again, the relationship between global money supply and Bitcoin is back in focus.

Introduction

As global liquidity conditions shift once again, investors are closely watching M2 money supply trends and their potential influence on Bitcoin. The relationship between money supply growth and Bitcoin price action has re-emerged as a key signal, with both gold and BTC showing renewed alignment with expanding liquidity.

This article revisits the core dynamics between M2 growth and Bitcoin, placing them in the context of today’s macro environment and what may be ahead.

The Correlation Between Bitcoin and M2 Growth

Historically, Bitcoin’s price has shown a notable correlation with the M2 money supply growth rate. Let’s break down the key trends observed over the years:

-

-

2014–2015: M2 Money Supply Contracted

During this period, the M2 money supply growth was either stagnating or decreasing. This decline correlates with the drop in Bitcoin prices, emphasizing the negative impact of reduced liquidity on BTC’s market performance. As the global money supply tightened, the demand for risk assets like Bitcoin likely decreased, leading to a bear market followed by market consolidation until 2016.

-

2016–2018: Bull Market

During this phase, M2 growth continued at a steady pace. The rebound in BTC’s price as M2 growth remained positive supports the idea that increasing money supply provides a favorable environment for Bitcoin price appreciation, followed by a short period of correction heading into 2019.

-

2020–2021: Pandemic Response

The COVID-19 pandemic prompted the US Federal Reserve to drop interest rates from 2% to 0% and inject unprecedented liquidity into the global economy. The rapid expansion of M2 during this time coincided with one of Bitcoin’s most explosive bull markets, as investors sought it as a hedge against inflation and currency devaluation.

-

2023–2024: Stabilization

As monetary conditions steadied, M2 growth flattened and Bitcoin prices reflected a corresponding phase of consolidation with limited volatility. Jerome Powell’s remarks at Jackson Hole signaled potential rate cuts. As macro investor Raoul Pal described in a YouTube video, this type of environment marks the start of what he calls “The Banana Zone” — a phase when liquidity returns and crypto markets begin to rise again.

-

2025: Early Signs of Acceleration

Entering mid-2025, Bitcoin is showing renewed strength as M2 begins to expand again and market expectations shift toward rate cuts. Unlike the prior period of consolidation, BTC is now leading traditional hedges like gold, which suggests we may be entering the early phase of a new liquidity-driven cycle. While still early, this breakout behavior aligns with historical patterns that often precede more sustained upside in crypto markets.

-

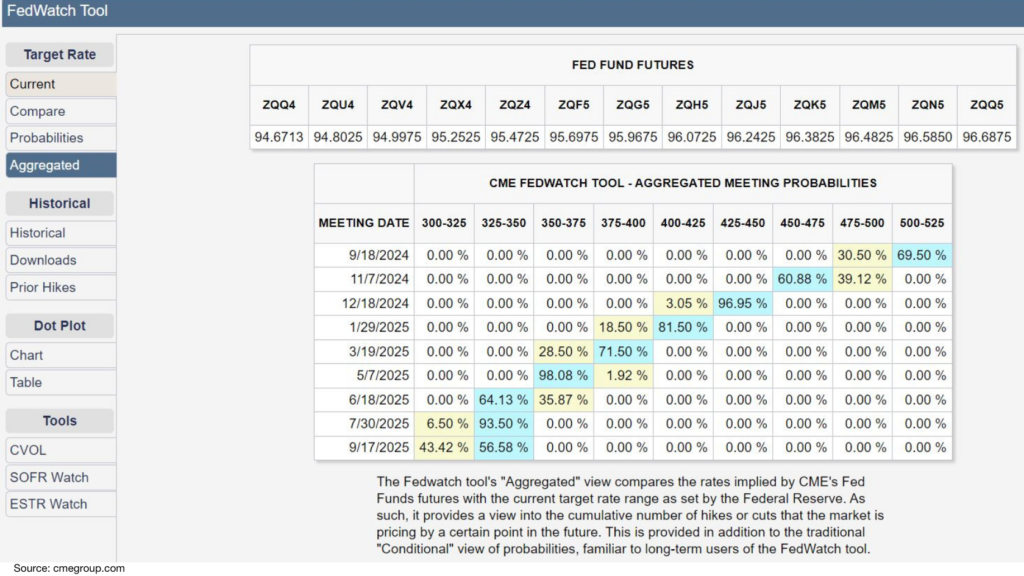

The Impact of Potential FED Rate Cuts

As the Federal Reserve (FED) navigates an economic landscape marked by inflation and slowing growth, there is increasing speculation about potential rate cuts. If the FED opts to reduce interest rates, it could significantly impact the M2 money supply and, by extension, the crypto market.

-

- Increased Liquidity: Lower interest rates typically lead to an increase in borrowing and spending, which can expand the M2 money supply. As more money flows into the economy, investors may turn to assets like Bitcoin, which is often viewed as a hedge against inflation and currency devaluation.

- Bullish Sentiment for Crypto: Historically, periods of FED rate cuts have coincided with bullish trends in the crypto market. As traditional assets offer lower returns due to reduced interest rates, investors often seek higher yields in alternative assets, including cryptocurrencies. This influx of capital can drive up Bitcoin’s price, leading to a broader bullish trend in the crypto market.

- Renewed Investor Confidence: Rate cuts signal that the FED is committed to supporting economic growth, which can renew investor confidence. This optimism can spill over into the crypto market, where Bitcoin and other cryptocurrencies are seen as viable investment options in a low-interest-rate environment.

Why This Correlation Matters

Understanding the correlation between Bitcoin, M2 money supply growth, and potential FED rate cuts is essential for several reasons:

-

- Investment Strategy: Investors can use M2 growth and interest rate trends as indicators of potential Bitcoin price movements, allowing them to make more informed decisions.

- Inflation Hedge: Investors seek assets like Bitcoin, perceived as inflation hedges, when central banks increase the money supply and cut rates, which may decrease the value of traditional currencies.

- Market Trends: Recognizing the patterns between M2 growth, rate cuts, and Bitcoin can help in anticipating broader market trends, especially in times of economic uncertainty.

Conclusion

Looking ahead, Bitcoin continues to show strong alignment with global liquidity trends. As M2 grows and central banks shift toward easier policy, both gold and Bitcoin are rising. This time, Bitcoin is outperforming.

Investors familiar with macro cycles recognize this pattern. Bitcoin tends to respond more aggressively to liquidity than traditional hedges like gold. It behaves as a higher-beta asset that reflects the same forces but with greater volatility and upside potential.

For those watching monetary expansion and asset flows, the relationship between M2 and Bitcoin remains a valuable signal. Liquidity is returning, and Bitcoin appears to be leading the way.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.