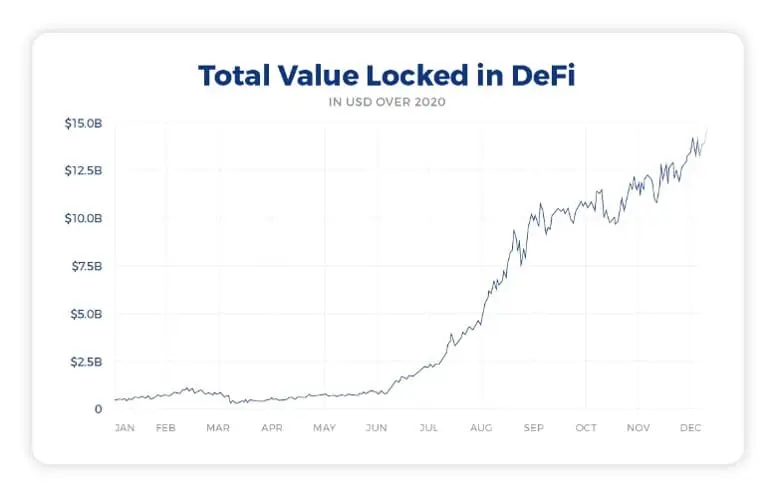

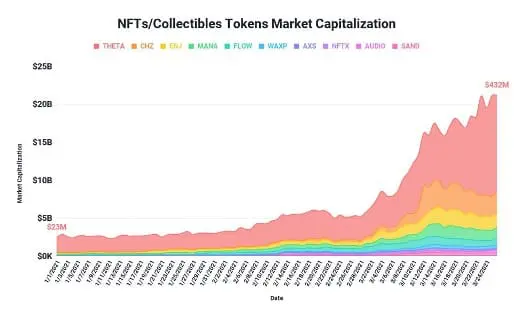

In the nascent history of cryptocurrencies, there seems to be a trend forming where sectors of the space are highlighted as they become large enough to sustain public adoption. This spotlight attracts not only eyeballs but also dollars, and better yet, stablecoins. We saw this occur in the summer of 2020 – called “DeFi Summer” – and then again in 2021, which was the year of NFTs and Metaverse tokens. In 2020, Uniswap’s monthly volume went from $169M in April 2020 to over $15B in September 2020, an increase of almost 100x. As for NFTs, trading reached $22bn in 2021, compared with just $100m in 2020 according to DappRadar. Seeing sector-specific growth over the last two years as blockchain adoption continues, begs the question: what will the summer of 2022 bring? This article will evaluate the introduction of layer 2 blockchains to the crypto ecosystem and how layer 2 chains are primed to support the incoming demand for blockchain transactions.

Source: Yield.app

Source: Forbes

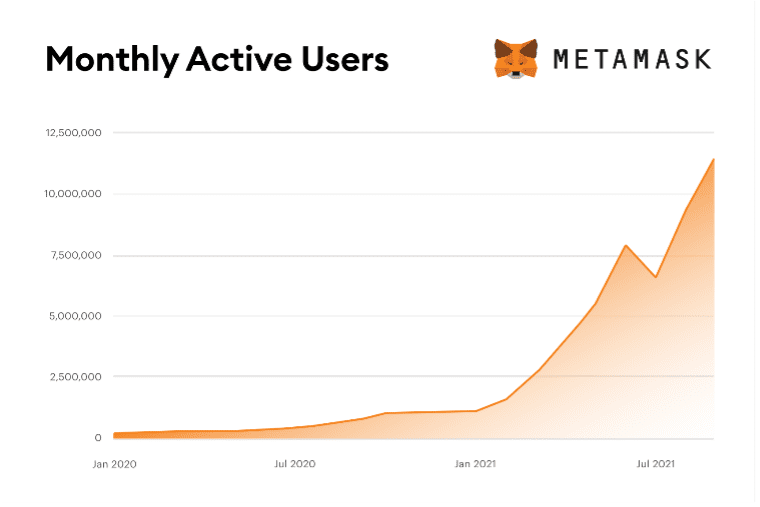

History doesn’t repeat but it certainly rhymes as the adage goes. All previous sector events were not random, but instances of consumer demand being met by technology that had begun scaling prior to a particular ‘landslide’ event. Defi protocols in early 2020 such as COMP and YEARN were already setting the standard of what decentralized finance would like and Uniswap (a decentralized automated-money-maker) went live just in time to fuel the fire with liquidity. NFT sales reached mass price and volume in 2021, just as MetaMask, a crypto hot wallet that acts as an interface with decentralized applications (dApps) reached 10,354,279 active users in August of 2021. The running theme for explosions in certain sectors of crypto is when an adopted technology intersected with consumer demand. In the case of NFTs over 2021, NFT markets were primed for consumer entry due to MetaMask’s large scale adoption, and when the two entities met, a wave of adoption followed.

Now, with a better understanding of how certain markets geared up for exponential growth, it is important to keep an eye on what areas of the market may be on deck for large scale adoption. At this point, we are observing the network congestion on the layer 1 blockchains – Ethereum (ETH) being the prime example – that stand as a barrier to entry to crypto for many people, as interacting on some layer 1s can be expensive and unsustainable. For example, the costs to transact on Ethereum are keeping new users out of the DeFi and NFT markets and pushing many others to alternative layer 1 blockchain ecosystems. The frustration crypto users are experiencing using Ethereum has prompted many to migrate their activity over to layer 2 blockchains, which are blockchains that have been engineered to run alongside and operate in parallel with layer 1 chains to relieve the layer 1 of some network congestion. Layer 2 blockchains are contributing to the scalability of the crypto ecosystem and will likely bring many users online and encourage more activity at cheaper costs and faster speeds.

The key player in the layer 2 realm is Polygon ($MATIC), a layer 2 blockchain that runs parallel with Ethereum. Layer 1s like Ethereum charge more in transaction fees – AKA gas fees – as the network gets more congested. In recent months, gas fees have risen to be in the hundreds of US dollars in a time of network congestion, meaning that for any action on the Ethereum network, users are paying hundreds to ensure their transaction is processed. This is a massive bottleneck for smaller transactions on the system that are not sensible with such high gas fees. Despite ETH’s plan to shift to a more scalable framework (ETH 2.0), these problems will remain rampant as the network approaches one billion active users.

Layer 2s come in different flavors that adopt distinct technologies like ZK roll-ups, which are heavily supported by Ethereum cofounder Vitalik Buterin. In a quick summary, ZK rollups allow transactions to be taken off chain and validated by Ethereum miners in the backend. This function lowers network congestion and ensures high security because the transactions are still being validated by ETH miners. The data will be maintained as anonymous, and any altercations can be caught in real-time as the data is “checked” by the layer 1 chain. In 2021 alone, Polygon spent almost a billion dollars in research on ZK roll-ups and other scalability technology.

With the current craze of NFTs and metaverse tokens, unless the transaction costs lower, blockchains will never be scalable to fulfill the demands of billions of users. This means that if 2021 was the year of the first wave of NFTs and Metaverse tokens, then 2022 may be the year that allows for the global adoption of the metaverse, decentralized finance, and NFTs through the scalability technology introduced by layer 2 blockchains. Layer 2 is a necessary innovation that is ripe to shape the future of crypto adoption.

By Parhesh Kumar

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]