GRT – 08/25/21

The Graph: $GRT – https://thegraph.com/

https://thegraph.com/blog/the-graph-network-in-depth-part-1

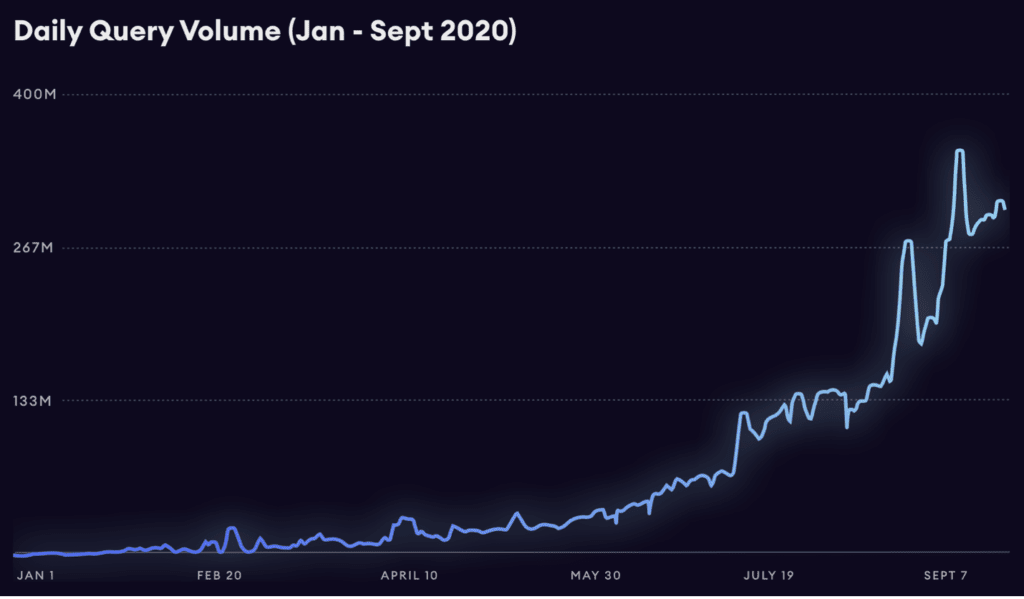

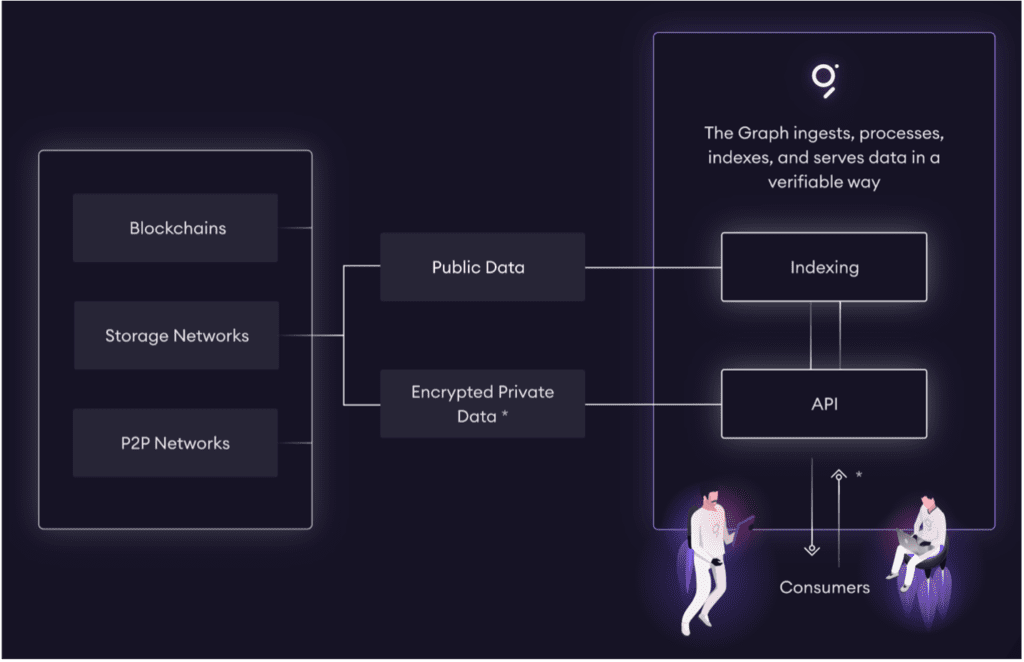

Investment Thesis – The Graph is an indexing protocol for querying blockchains that publish open APIs (subgraphs) allowing easy access to blockchain data. This is important because there is too much blockchain data to be reasonably and timely interpreted. Although the use-cases may be unclear for the typical investor, developers can see the potential evident by a stagnant price and volume.

Graph provides services to address the quickly increasing demand for blockchain queries. To incentivize their services they offer features including, Agency, Reliability, Interoperability, custom money/contracts, security, and governance. With these features enabled, both the Graph protocol and user experience are improved. The backend infrastructure Graph provides allows entrepreneurs to develop the UX/UI for an increasing number of dApps, commonly in the DeFi, Governance, Grants & Philanthropy, Marketplace, Entertainment, and Social space.

The Graph Protocol

The Graph is a daunting Web 3.0 technology that could be confusing to many, despite this anyone can participate in The Graph protocol regardless of technical experience. The Graph issues token rewards to four types of users:

Developer (Technical): Either creates new subgraphs or integrates existing ones into dApps.

Indexers (‘Semi-technical”): Operates the nodes required to index data and complete queries.

Curators (non-Technical): Organizes/simplifies data from signaling subgraphs.

Delegators (non-Technical): Secure the networks governance by delegating GRT.

Availability – Coinbase, Binance, Binance, KuCoin, Kraken, FTX, Uniswap, Huobi, Bitstamp, Bittrex, Crypto.com, Sushi swap, 1inch, Coinex, Bilaxy, Bitmart, Blancer (so many others).

Price Information, Charts, Market Cap – Trading around $.69 as of 8/5/21. This coin peaked in February 2021 at $2.7

Token Update – On July 13th, Graph announced 2.8 million for ecosystem support in Wave 2, in addition to $60M Core Dev Grant to StreamingFast. Graph reports they have over 100 applications from Brazil, Canada, Japan, Russia, US, and others. For more info on Wave 2 read here: https://thegraph.com/blog/wave-two-funding

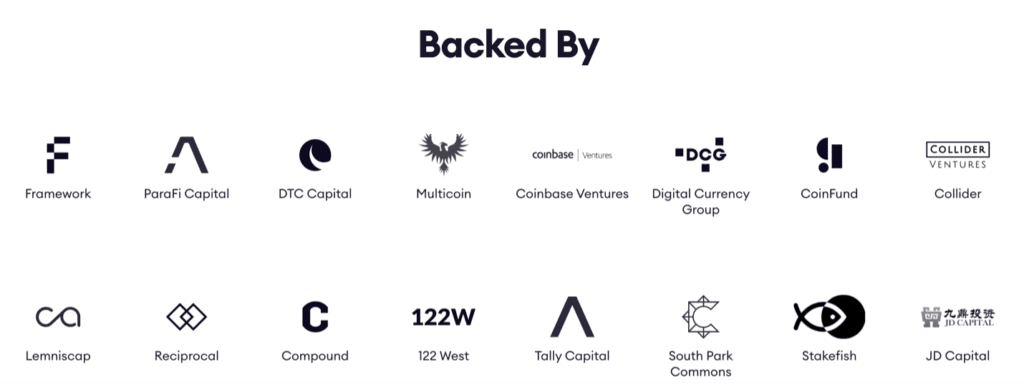

Competitive Rivalry/Threat of Substitution – Setting aside the high barrier of entry into the API and Web3.0 space, Graph is backed by a large roster of subgraphs, available to any developers using the application, Uniswap being an example. API endpoints are available for every subgraph, allowing subgraphs to be connected. It is hard to imagine that a competitor will take on this daunting task and try to duplicate the infrastructure when it is already publicly available. Additionally, GRT offers many use cases for ‘non-technical’ users, which is impressive given the nature of the token.

Risk & Disclaimers – The Graph opens the possibility of collecting data on the blockchain, which has ethical downsides but creates opportunities for developers to focus on the UX/UI side of applications and allows Web2 companies to more seamlessly transition.

Graph is currently overbooked and understaffed for their Wave 2, but they are strategically accepting projects that will build their ecosystem making it more difficult for competition to build one. As previously mentioned, they recently raised more capital for Wave 2 development.

Graph is available on many different exchanges including Coinbase and Binance, so it is easy to buy in crypto standards, possibly because these exchanges use GRT. Nevertheless, the stagnant price suggests minimal understanding from the average retail investor.

Graph is not a small cap coin; it ranks 39 at the time of writing. However, a peak price nearly 5x of the current price demonstrates room for growth, especially considering that GRT is currently starting ‘Wave 2’.

Market Position Power – Graph is unique, as indexing blockchains were commonly believed to be impossible, and not only that they have graphs of multiple blockchains, and many subgraphs in each. They accept blockchain as the future internet and have the vision to graph the entirety of crypto.

Buyer/Seller Power – When considering the lower-than-expected volume, stagnant price, active discord (+26,000 members), and complex technical nature of the token, we believe the most-likely-most-common holder of this token may be Web 3.0 developers that understand the future implications of this token and have Hodl’d since.

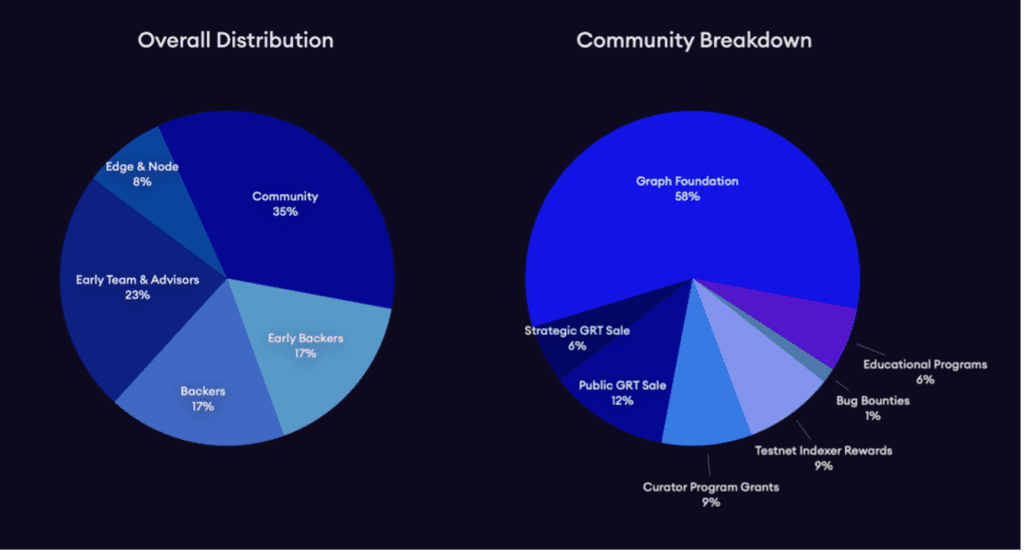

The above distribution schedule illustrates how developers hold most of the GRT, proof developers’ confidence. Their confidence helps to validate doubt about the practicality and functionality of the technology.

Closing Thoughts:

The opportunities that GRT poses may not be reflected in the current spot price. Wave2 is in the early stages of development and will take at least 6-months. However, The Graph believes that their technology will ‘Sunset the Hosted Service’ with a smooth transition.

Sources:

The Graph Homepage: https://thegraph.com/

Roadmap & Distribution: https://thegraph.com/blog/announcing-the-graphs-grt-sale

Participation & Tokenomics: https://thegraph.com/blog/the-graph-grt-token-economics

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]