Trump took centerstage at the annual CPAC convention over the weekend. He said that he alone could prevent World War 3, presumably referring to a future US/China conflict. How might Trump’s plan to weaken a future adversary such as China inadvertently weakens the dollar and help Bitcoin? Indulge the following opinion.

Trump has historically found fertile political ground suggesting that he would hold foreign governments accountable for harm they have inflicted on the United States. (See for reference, “build wall, make Mexico pay for it”) For the coming election cycle, especially given the conclusions recently reached by the Department of Energy the COVID-19 pandemic was most likely caused by a lab leak in China, I expect a major discussed in relation to the pandemic is the question of responsibility. Who should be held accountable for the spread of the virus, and what actions should be taken to hold those accountable responsible and to prevent future pandemics?

In this regard, Trump’s track record can give a hint to how he may proceed. Historically Trump has taken a hardline approach towards China, accusing the country of not being transparent about the virus’s origin, in its handling of the pandemic and going Tit-for-tat on trade sanctions in 2020. Coupled with Trump being vocal about his displeasure with China’s trade policies and the trade deficit between the two nations, Trump is likely to suggest that the US should take some action against China regarding the COVID-19 pandemic.

One possible action that Trump could take in campaigning is that China should be held financially responsible for the damage caused to the United States as a result of the pandemic. One such way that may be proposed for extracting this retribution may be the halting of payments for China’s US Treasury holdings or canceling the obligations all together.

China is one of the largest holders of US Treasury bonds, and any move to halt payments or cancel these debt obligations for these holdings could be framed to have a benefit to the U.S. debt service and or total deficit… at least in the short term. These actions would have a significant impact on China’s economy as it depends on these payments for its own social programs. This could be seen as a hardline approach by the U.S. towards China, with potential consequences for both nations’ economies. These actions may never be implemented, but it’s this authors’ suggestion that the very socializing of this idea could have a dramatic impact on the treasury market and therefore the U.S. dollar.

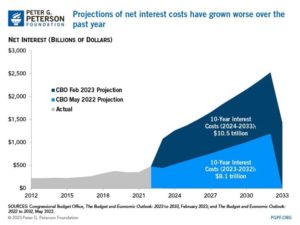

If China were to start selling their Treasury holdings in anticipation of a Trump presidency, it could cause a significant decrease in demand for US Treasury bonds, leading to a decrease in the value of the U.S. dollar. (and create even higher funding costs for the U.S. which is already grappling with the reality that in today’s higher interest rate environment national debt service as a line item in the U.S. budget is up nearly 100% over the last two years and is expected to continue to rise quickly,)

According to the non-partisan Cato Institute, interest and principal payments on national debt which will total $863 Billion in 2023, already exceeding national military spending ($746 billion) and Medicare spending ($700 billion). It is estimated that within a decade interest payment alone will reach $1.2 Trillion annually, eclipsing all other categories of federal spending before even considering principal payments.

While canceling the principle or interest payment on this debt may seem like a good idea since over $1 Trillion of the debt is owned by China, doing so, or even suggesting doing so, could have ripple effects on both China, the U.S. and other countries and their currencies, leading to a global economic effect which will be felt the greatest in the United States.

Reduced demand for U.S. dollar denominated assets, such as Treasury obligations would lead to a decline in the U.S. dollar. A decline in the US dollar will have an immediate and positive impact on the price of assets that are dollar denominated, a phenomenon well understood by gold investors. Oil, gold, Bitcoin and Ethereum, (the currency that denominates Trumps wildly popular NFT Collection ) would all see their prices in dollars increase as the actual purchasing power of dollars declines.

Its long been wondered when, if ever, China would stop buying US Treasury debt. Could this rhetoric, even in never realized be the proverbial straw to break the camel’s back? If it ends up being the case, expect to see Bitcoin take a more prominent role in foreign reserve currency mix held by China and other nations. If you find this scenario disturbing, be even more disturbed that Trump need not even be elected to see this scenario put in motion, the rhetoric alone could be enough to spur action. If you were China, would you start unloading debt now, or wait till it was too late? The good news is it’s still not too late for investors to establish “insurance holdings” of Bitcoin or gold.

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]