FULL REPORT: World Liberty Financial: A Crypto Fed in the Making?

World Liberty Financial (WLFI) is positioning itself as a potential ‘Federal Reserve for Crypto,’ blending Decentralized Finance (DeFi) innovation with a structure echoing traditional financial giants. Launched by a powerhouse team—including Trump family members and seasoned experts—it raised $590 million in a $WLFI token presale, marking it as the 8th largest private token sale ever, and valuing the project at $1.25 billion. With 25 billion tokens capped at $0.05 each and locked for 12 months, it drew 85,000 accredited investors. This isn’t just another crypto project—it’s a calculated effort to bring stability and governance to the volatile blockchain world, much like the Fed does for traditional markets.

A Team Built for Impact

World Liberty Financial’s leadership combines political influence and technical expertise. Donald Trump, the “Chief Crypto Advocate,” champions it alongside his sons Barron (the “DeFi Visionary”), Donald Jr., and Eric (Web3 Ambassadors). Beyond the family, co-founder Steven Witkoff, serving as the U.S. Special Envoy to the Middle East, wields immense geopolitical influence through his diplomatic expertise, steering critical negotiations in current wars and pushing to de-escalate the Ukraine-Russia conflict, while Rich Teo, who co-founded Paxos—a blockchain pioneer brings unmatched insight into digital asset stability and infrastructure, making him a vital force in shaping WLFI’s groundbreaking stablecoin ($USD1) initiative. This isn’t a flashy Trump-branded stunt—WLFI’s quiet $590 million raise and focus on governance signal a serious play. For VCs, it’s a team with the clout and know-how to bridge crypto and institutional finance all while ensuring compliance with the new landscape of the United States’ approach to digital assets.

Mirroring the Fed’s Playbook

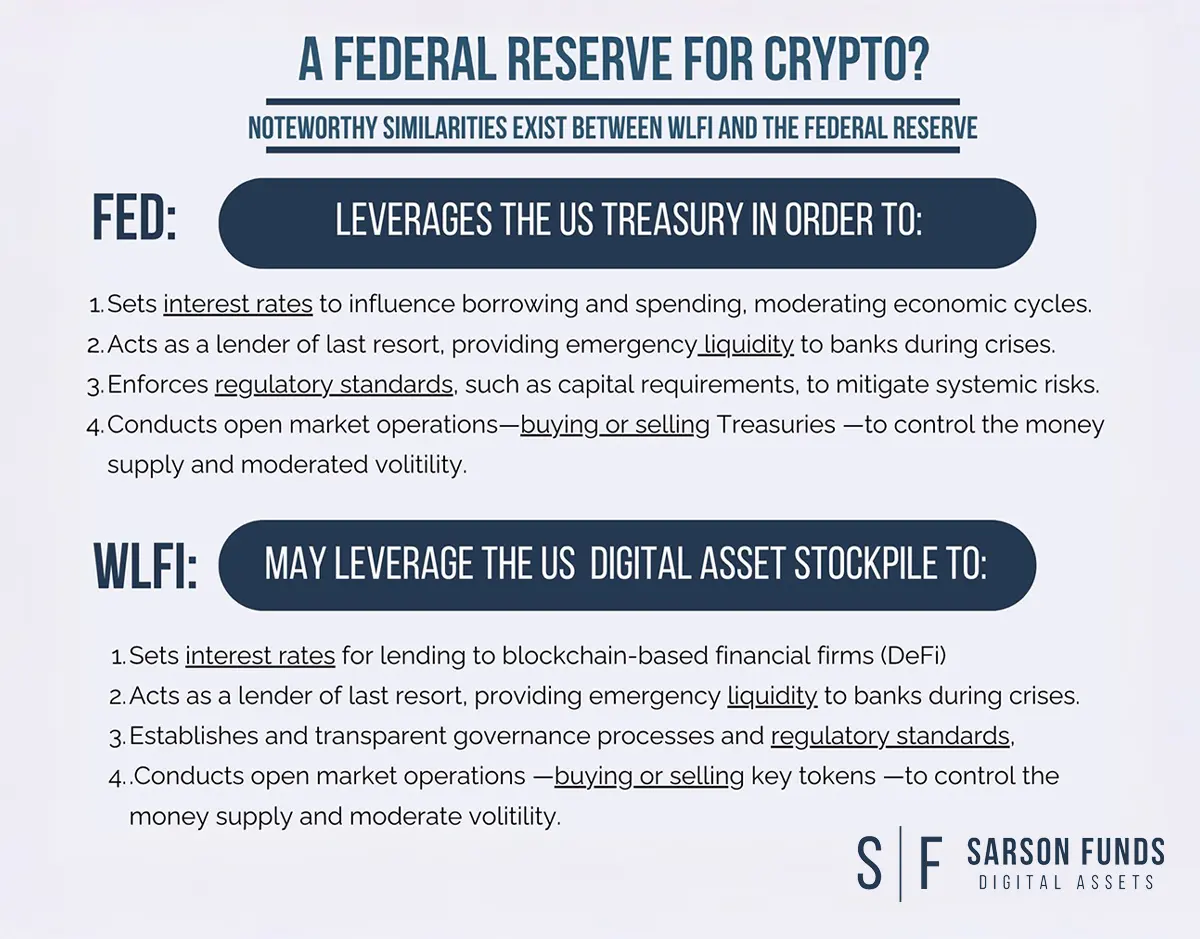

The Fed stabilizes traditional markets by setting interest rates, providing emergency loans, enforcing rules, and managing money supply. WLFI aims to do the same for crypto. Its $WLFI token holders vote on policies—like the Fed’s Open Market Committee—shaping lending rates and liquidity. The platform offers yields on crypto deposits and loans against digital assets, akin to the Fed’s discount window for banks. Experts will note the parallel: WLFI could use a rumored U.S. Strategic Crypto Reserve—to buy distressed assets during crashes (think FTX 2022) or adjust rates to cool speculative bubbles, fostering a steadier DeFi ecosystem and standardizing lending/borrowing rates to some degree.

The Strategic Crypto Reserve Connection

The proposed U.S. Strategic Crypto Reserve could be WLFI’s ace. This $17 billion of crypto being held by the US Government could act as the treasury for digital assets, aiming to curb volatility and backstop failing institutions. WLFI might tap it to stabilize markets—much like the Fed uses Treasuries—deploying assets during downturns or tweaking borrowing costs to balance growth and risk. For novices, picture this: WLFI could act as a crypto safety net, stepping in when markets wobble. For VCs, it’s a chance to back a platform tied to a government-backed vision for U.S. crypto dominance.

Why WLFI Matters for Investors

WLFI’s $1.25 billion token sale isn’t just a flex—it’s a governance powerhouse. Locked tokens give holders a say in a platform that could set DeFi standards, attracting hedge funds, crypto exchanges, and high-net-worth players. Its regulatory-friendly design—KYC checks and non-transferable tokens—eases compliance concerns, while its “Macro” portfolio shows active crypto investments via Coinbase and Binance. For VCs, WLFI offers exposure to a stabilizing force in DeFi, backed by a Trump-led push for digital finance leadership. It’s a rare blend of innovation, influence, and stability worth watching.

Disclosures: This document is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc., does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc., is not liable for any losses or damages resulting from its use.