How the Equity Premium is Reshaping Crypto Markets and the Investment Opportunities Created

The playbook for institutional crypto capital allocation has fundamentally changed. Treasury Management Companies (TMCs) and Digital Asset Treasuries (DATs)—public vehicles that warehouse crypto on their balance sheets—have become central actors in today’s market, and their influence is only set to grow. As public market investors pay a structural premium for equity backed by large, liquid crypto assets, they have driven a virtuous (and self-reinforcing) cycle of capital formation, price appreciation, and deepening liquidity in these “treasury-eligible” tokens.

Why TMCs and DATs Command a Premium

Publicly traded “crypto treasury” companies offer equity exposure to digital assets—think Bitcoin, Ethereum, Solana—without the direct frictions of custody and compliance. The draw is simple: public investors are willing to pay $2 for $1 of crypto on these balance sheets, seeking the benefits of equity liquidity, brokerage account accessibility, and operational leverage to rising token prices.

This “treasury premium” often fetches valuations from 60-110% above net asset value (NAV) for blue-chip Bitcoin treasuries and mid-triple-digit percentage premiums for altcoin-focused vehicles. The surge is doubly potent for newly rebranded or single-asset DAT companies: it’s not uncommon to see share prices double or triple in response to a strategic pivot and PIPE (Private Investment in Public Equity) transaction. The end result: a rush to create more vehicles, accumulate eligible tokens, and capitalize on the premium.

Mechanics: PIPEs and the Six-Month Cycle

PIPE transactions have emerged as the go-to capitalization model. These private equity investments are typically subject to a practical, if not contractual, 6-month “seasoning” window before shares can trade freely on the secondary market. This unlocks a unique arbitrage window:

-

- Institutions warehouse large-cap tokens, contribute them to the DAT, then wait out the six months for the equity premium to crystallize.

- Meanwhile, sponsors race to deploy capital, amplify the treasury narrative, and build conviction that the premium will persist at the unlock.

This timing dynamic drives intense, near-term demand for top-20 cryptocurrencies as professionals scramble to assemble and hedge inventory ahead of new placements.

The Treasury-Eligible Asset Effect

A defining shift triggered by TMC/DAT proliferation: Institutional capital is flooding only a shortlist of “treasury-eligible” tokens—usually the top 20 by market cap.

This has meaningful consequences:

-

- Large-cap tokens like BTC, ETH, SOL draw systematic inflows.

- Mid- and small-cap tokens—have been increasingly sidelined by capital allocators focused on premium trades.

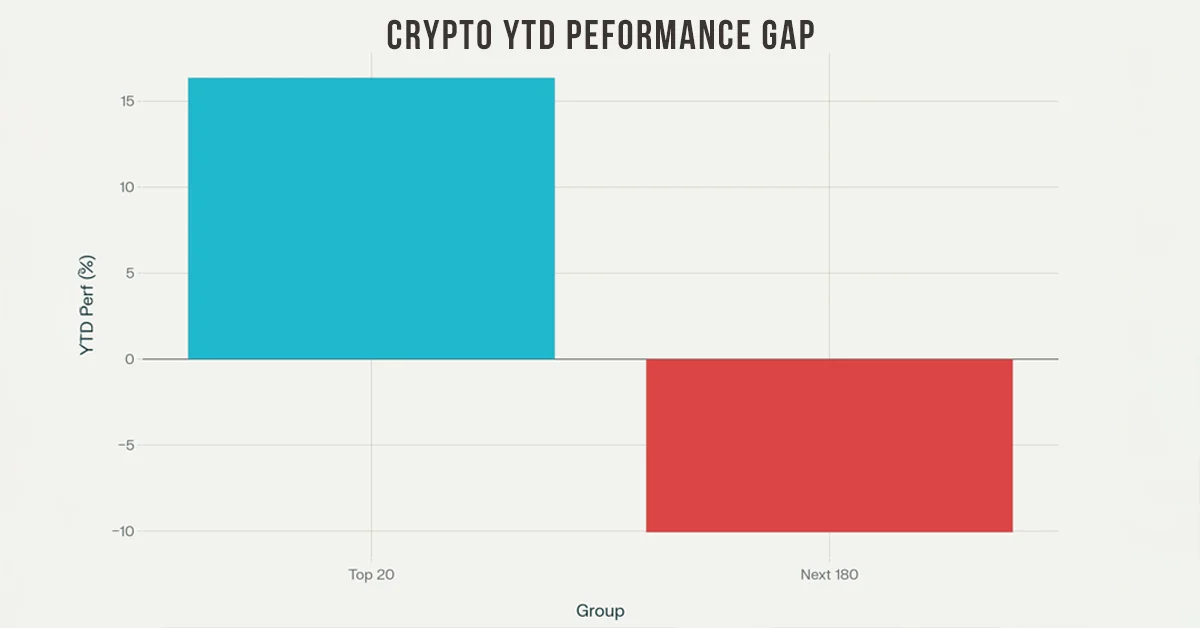

Traditionally, venture funds and hedge funds played actively in Token Generation Events (TGEs), pre-sales, or tactical “dip-buying.” Now, many must divert resources to amassing DAT-compliant assets. The February 2025 “Tariff Tantrum,” which rocked wider crypto markets, exemplified this: VCs focused on treasury trades missed attractive spots in off-benchmark tokens that were otherwise selling off. This bifurcation of the market can be seen by comparing the year-to-date performance of the 20 largest cryptocurrencies to the next 180 largest. “Treasury Eligible” cryptocurrencies delivered an average return of 16.36% this year, while the next 180 largest cryptocurrencies (ranks 21-200) posted an average decline of -10.06%, creating a substantial 26.42 percentage point performance gap.

Case Studies: Neglected Tokens, New Opportunities

-

- Virtuals Protocol (VIRTUAL): Hit a $5.07 all-time high in Jan 2025, but has slumped 69% since, despite robust market capitalization and innovation in AI monetization. Underrepresented institutionally due to treasury-eligible thresholds.

- Render (RNDR): Down 74% from March 2024 highs, buoyed by expanding AI compute utility but still largely ignored by treasuries focused on the top-20 cut-off.

- Helium (HNT): Down 95% from 2021 peaks, even amid major real-world adoption and Solana migration— its weakness at least partially due to its exclusion from the treasury-eligible club.

What Happens When the Lock-Ups Expire?

The capital rotation is poised to accelerate. Many DAT PIPE deals from earlier in 2025 are reaching their 6-month unlocks now and should continue and accelerate through the end of the 1st quarter 2026, releasing billions in previously locked equity. As these shares hit the secondary market, we expect both selling pressure, which should result in a decline of premiums, and a wave of capital searching for redeployment.

-

- Over $15 billion in PIPE-funded DAT exposure reaching maturity is set to be redeployed in the next 12 months—a tailwind for the next generation of projects.

- Initially, some of this capital will be allocated to large-cap tokens to rebuild original positions, but even once positions are rebuilt, there should remain significant excess capital that will need to be deployed.

- Given lower valuations and recent industry-wide under allocations to small and mid cap token project, Sarson Funds sees a growing opportunity in holding under-owned small and mid cap projects with solid fundamentals.

The Road Ahead

DATs and TMCs have transformed the structure and psychology of crypto capital markets. They have created both repeatable sources of outperformance—via equity premium trades—and pockets of compelling value in the tokens they neglect. As the cycle turns, understanding these flows and respecting the time-based mechanics affecting token contributors to TMCs and DATs will allow investors to position portfolios for predictable post-unlock reallocations. At Sarson Funds we believe that established small and mid cap projects, especially those already reviewed and green-lighted by large crypto VCs like Arrington Capital, Digital Currency Group, Pantera and Galaxy Digital, will be best placed to win as these massive investors seek to return portfolios to pre-TMC/DAT market allocations.

We view the coming quarters as an inflection point: Expect continued strength and liquidity in the top 20, but also be ready for a renaissance in smaller-cap names as forced reallocation and rising institutional comfort propel new winners. We think it is an opportune time to consider the Sarson Funds Small Cap portfolio or the Sarson Funds Decentralized AI portfolio, both currently undervalued, in our opinion.

Want to share this insight with your network?

👉 Click here to view and share this article on LinkedIn

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.