The Bitcoin fixed supply of 21 million coins is a deliberate feature built into the protocol by its pseudonymous creator, Satoshi Nakamoto. This cap is not arbitrary; rather, it is foundational to Bitcoin’s economic design and enforced by every participant in the network through decentralized consensus.

Bitcoin’s Issuance Schedule: Halvings and Scarcity

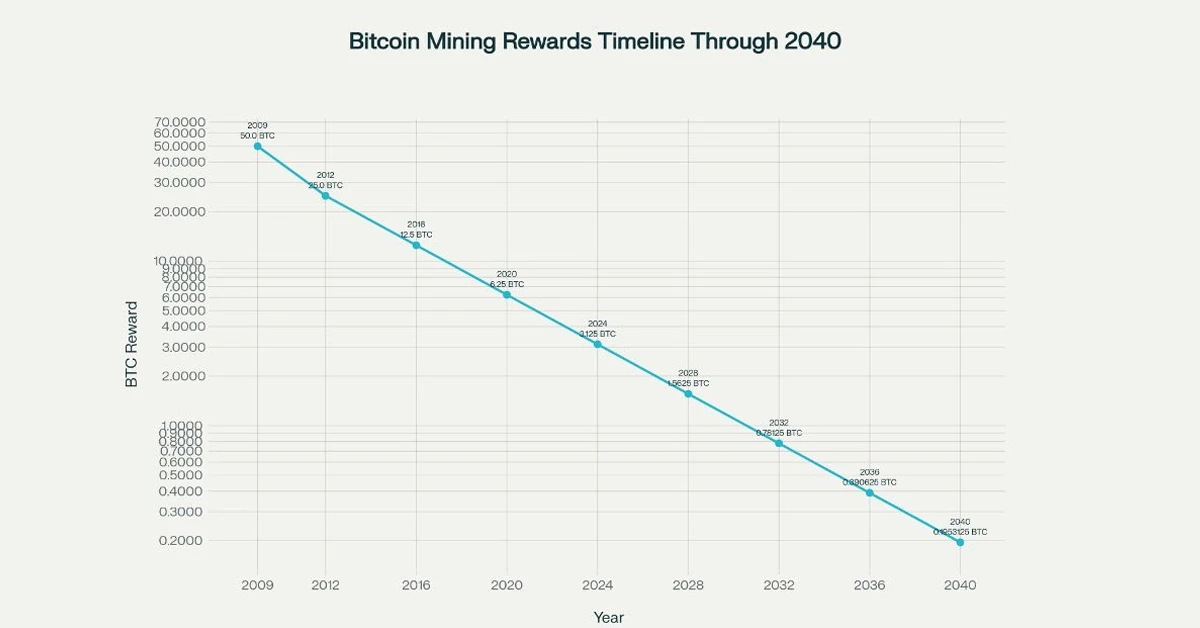

A key element supporting Bitcoin’s limited supply is its programmed issuance schedule. When a miner successfully validates a new block of transactions, they receive a reward in the form of newly minted bitcoins. However, this reward decreases over time through a recurring event known as a “halving,” which occurs approximately every four years, or every 210,000 blocks.

In 2009, miners earned 50 BTC per block. This amount was halved to 25 BTC in 2012, then to 12.5 BTC in 2016, 6.25 BTC in 2020, and 3.125 BTC in 2024. Future halvings will continue this trend. The final fraction of Bitcoin is expected to be mined around the year 2140. Each halving reduces the rate of issuance, steadily bringing the total supply closer to the protocol’s hard cap of 21 million coins.

The chart below illustrates Bitcoin’s block reward reductions over time:

This gradual decline in issuance ensures that the remaining supply becomes increasingly scarce, reinforcing Bitcoin’s deflationary characteristics.

Predictability and Transparency in Bitcoin’s Supply

Bitcoin’s issuance follows a transparent and predetermined schedule, offering a stark contrast to fiat currencies, which can have their supply expanded or contracted at the discretion of central banks. Bitcoin’s monetary policy is enforced by open-source code, enabling anyone to audit or verify the system in real time.

This transparency fosters trust among users because no single party can arbitrarily alter the rules or manipulate the supply.

The Mathematical and Technical Basis for Bitcoin’s 21 million Limit

Bitcoin’s 21 million cap is the result of its mathematical design. The network rewards follow a geometric progression through the halving mechanism, with the sum of all rewards converging to 21 million coins. This structure helps to maintain scarcity, reduce inflation, and promote long-term stability.

While the specific number, 21 million, has sparked ongoing debate, many analysts agree that it was chosen to align incentives, ensure sustainability, and create a predictable monetary supply that mimics the scarcity of precious resources like gold.

By limiting supply and embedding issuance rules directly in the code, Bitcoin offers a self-regulating monetary system. Its design reflects a broader vision for financial independence where monetary policy is immune to central control and driven by math, not politics.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.