All businesses are guilty of complacency at times. Sometimes that complacency can remain unchecked for years. Ultimately, better, faster, cheaper wins. Western Union, MoneyGram, SWIFT, it’s been nice knowing you. In the crypto industry, we call the disruptive application of blockchain technology “getting crypto-ed” (‘crypto’ being the placeholder for any and all applications of blockchain technology).

As it turns out, even disruptive crypto-startups themselves can get crypto-ed.

Such is the case now with crypto exchanges. Coinbase, Bittrex, Binance, Kraken, Gemini and the like have attempted a head-on disruption of traditional stock and commodity exchanges. Buried under an onslaught of new regulation, however, the exchanges have not met the demands of either crypto traders or token issuers. Traders are demanding access to newly minted globally available tokens while token issuers are looking for markets to list their tokens.

Add to that the cost of listings and time. Exchange listings easily cost hundreds of thousands of dollars and often take months. Jurisdictional issues have also become a hindrance as exchanges are closing off individual token markets to traders in certain jurisdictions (such as the US and Europe).

Crypto disruption is swift and without bias, even towards other crypto disruptors. So something had to give, and it did. Crypto traders found a work-around in the form of a “swap” with another holder of the desired asset. Startup decentralized platforms such as Uniswap, Balancer, Curve, Compound, Synthetix and many others have created marketplaces where traders buy and sell with one another in a trustless, near instant way, using Etherum-based smart-contracts as a behind-the-scenes framework for the transaction. This enables traders to swap one crypto for another without counter-party risk or the need for any third-party involvement. And boy, did the market like it!

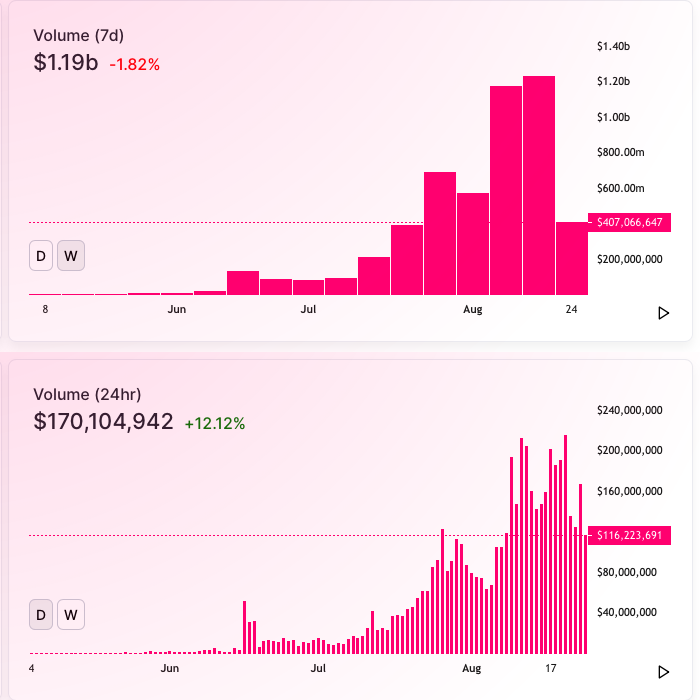

(Source: Uniswap.info/home – August 25, 2020)

Transactions in this swap market happen “on-chain”, which in the opinion of anyone who believes in the core tenants of cryptocurrencies, is infinitely preferable to working with an exchange partner who may or may not be designated as a “custodian” by a governmental agency who ultimately can interfere with the execution of a transaction.

These swap platforms have soared in popularity and have taken volume and its associated fees away from crypto exchanges. Uniswap now does nearly $200mm in volume per day, more than most “established” exchanges. Also, the fee revenue for making a market (in a very crypto fashion) flows to the person providing the liquidity, not to the exchange. Mark it down as another fee disintermediated and returned to the customer.

We’ve barely scratched the surface on the number and type of businesses that will be “getting crypto-ed” in the next few years. (Title insurers, mobile networks, and financial services – I’m looking at you). Any business not leveraging new technology is at risk of innovation-borne disruption. The best businesses know that constant technological vigilance is a prerequisite for survival. Companies that have joined the Ethereum Enterprise Alliance see the barbarians at the gate and are making the right moves. Unfortunately, sometimes even seeing the barbarians is not enough to save your business from being “crypto-ed”.

By John Sarson, CEO

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]