As a decentralized asset, Bitcoin’s global independence shields it from the impact of U.S. elections. Regardless of who assumes the presidency, Bitcoin remains unaffected by national policies. Its appeal lies in its role as an alternative to traditional financial systems, which some view as flawed.

With the U.S. debt continuing to climb, Bitcoin is viewed by many as a hedge against inflation and economic instability. Interest from major asset managers like BlackRock, Vanguard, and State Street reflects a growing recognition of cryptocurrency and blockchain technology. These developments suggest that Bitcoin’s role as a decentralized, borderless asset is being acknowledged on an institutional level, drawing attention to its utility as an independent store of value.

Trends and Opportunities for Post-Election Investment Diversification

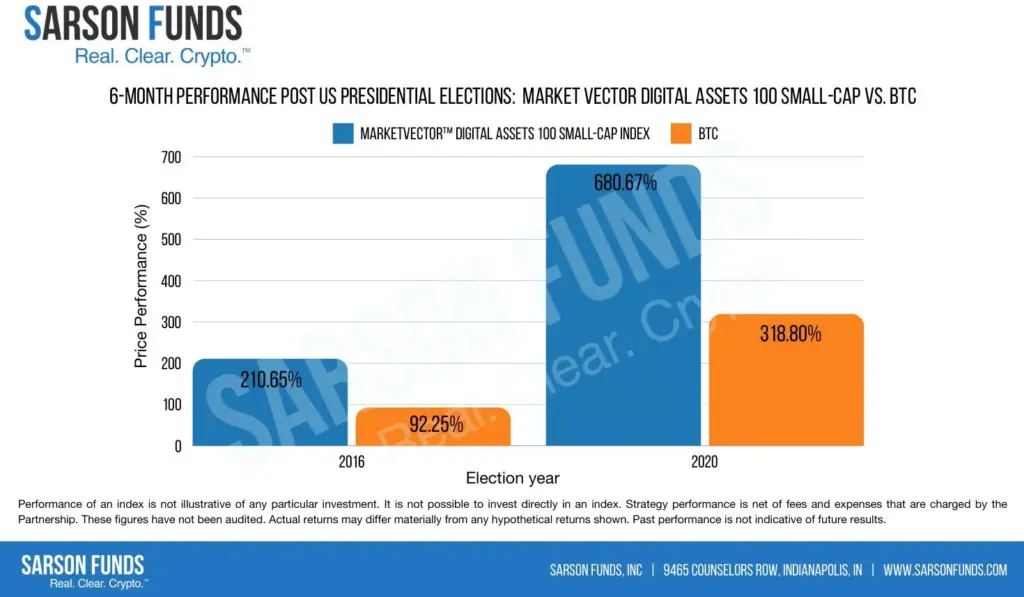

Post-election trends provide valuable insights for those interested in the digital asset space. Historical data shows that Bitcoin and small-cap cryptocurrencies have often performed well in the aftermath of U.S. elections, attracting increased investor interest in the crypto market. This trend underlines how crypto assets can thrive even amid political transitions that can impact traditional markets.

According to the chart above, small-cap crypto assets and Bitcoin experienced significant gains in previous post-election cycles, including a 680.67% increase for small-cap assets and 318.80% for Bitcoin in 2020. Notably, The Small Coin Strategy (Fifth Khagan, LP) has consistently outperformed traditional small-cap crypto indices, offering a unique approach within the evolving digital asset landscape. As of September 30, 2024, based on estimated, internally calculated figures, Fifth Khagan, LP, a Small Coin Strategy, recorded a 90.2% return since its inception, vastly outperforming the 100 Small-Cap Crypto Index, which has returned -56.0% over the same period. This performance highlights the potential of actively managed crypto strategies to navigate volatility and capitalize on the high-growth segments of the market.

Why Bitcoin’s Independence Matters

Bitcoin’s global independence and decentralized nature resonate strongly with investors seeking alternatives to traditional finance. In a world with rising debt levels and central banks facing challenges in maintaining economic stability, Bitcoin stands out as a store of value that is not tied to the monetary policies of any single country. Bitcoin is unaffected by who wins the U.S. presidency—its value lies in its independence and the trust its decentralized network provides.

As institutional interest continues to grow and post-election trends show promising gains, Bitcoin’s role in a diversified portfolio becomes clearer. For those concerned with the fragility of traditional financial systems, Bitcoin and other cryptocurrencies present a compelling solution that transcends borders and political cycles.

Disclosures: Sarson Funds, Inc. is a third-party marketing company and does not directly manage assets or provide investment advice. This information is for educational purposes only and is not intended as investment advice. It is recommended to consult a professional financial advisor before making any investment decisions. Past performance does not indicate future results. The opinions expressed here are solely those of the authors. Therefore, please consult with an investment advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].