Former President Donald Trump recently suggested that Bitcoin could help address the $35 trillion U.S. national debt, a heavy burden on the country’s economy. This leads to an important question: Can Bitcoin solve the U.S. national debt? While this idea sparks curiosity, let’s explore its practicality, especially considering Bitcoin’s current price and insights from the Bitcoin Rainbow Price Chart.

-

-

Bitcoin and the National Debt: Can It Really Help?

-

The U.S. national debt poses a huge challenge, leaving many to wonder: Can Bitcoin solve the U.S. national debt or at least play a role in reducing it? Traditional solutions include cutting spending, raising taxes, or boosting economic growth. Trump’s unconventional proposal suggests leveraging Bitcoin. Here’s how it might work:

-

-

- Bitcoin as a Reserve Asset: The U.S. government could hold Bitcoin as a long-term store of value. If Bitcoin appreciates, it could sell off portions to reduce debt. However, this strategy is speculative and depends on future price increases.

- Inflation Hedge: With its fixed supply, Bitcoin is often seen as a hedge against inflation. If the U.S. continues printing money, Bitcoin’s scarcity could make it valuable. However, while this may benefit individual investors, its direct impact on national debt reduction is unclear.

-

However, with Bitcoin’s market cap around $600 billion, even a significant increase in value would not substantially reduce the $35 trillion debt. Additionally, Bitcoin’s decentralized nature would limit the U.S. government’s control over monetary policy if adopted as a reserve asset or currency.

-

-

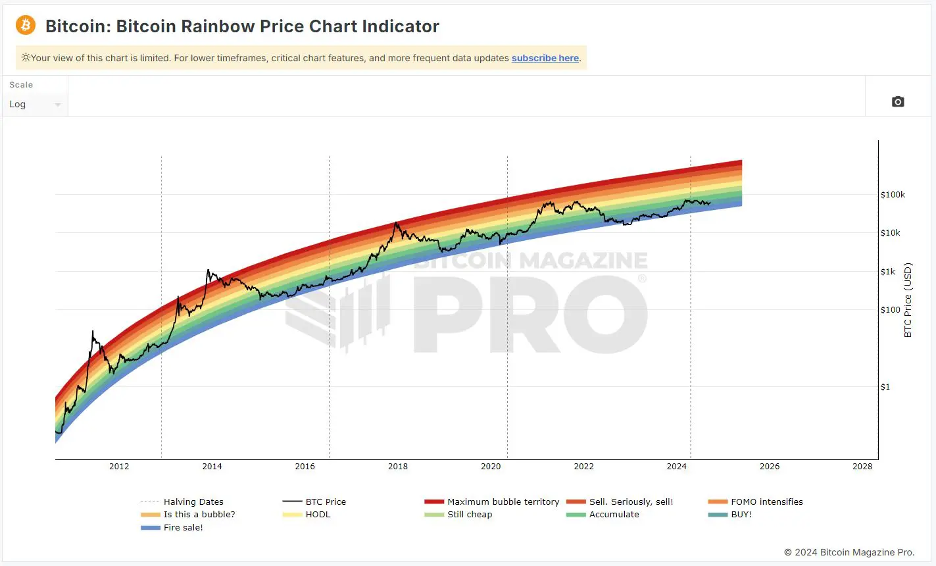

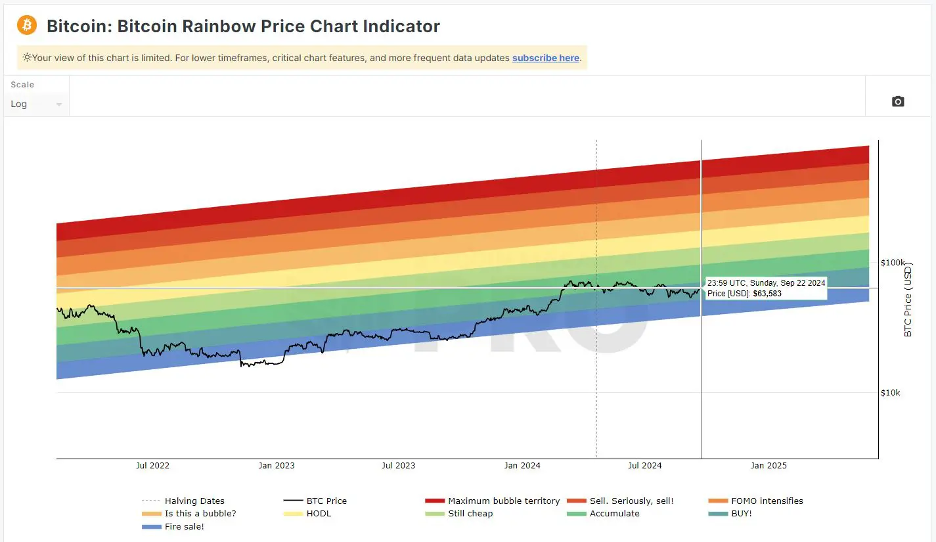

What the Bitcoin Rainbow Chart Says

-

As of now, Bitcoin is priced at $63,500, placing it in the blue-to-green zone of the Bitcoin Rainbow Price Chart, indicating:

-

-

- Blue Zone (“Fire Sale!”): Bitcoin is undervalued, typically signaling a buying opportunity.

- Green Zone (“Accumulate”): Bitcoin remains relatively cheap, suggesting it could be a good time to accumulate before potential price increases.

-

-

-

Could Bitcoin Appreciation Help?

-

Given its current undervaluation, Bitcoin may be positioned for future growth. Historically, Bitcoin has followed cycles of undervaluation and overvaluation, and many investors view these low zones as signals of an upcoming bull run.

If Bitcoin were to experience a significant price surge, it could become a more valuable asset for the U.S. to hold. However, such price movements are speculative, driven by broader adoption and economic trends.

-

-

Challenges of Using Bitcoin for Debt Reduction

-

Despite Bitcoin’s potential for appreciation, several challenges make it an unlikely solution for the U.S. debt:

-

-

- Volatility: Bitcoin’s price is highly volatile, making it a risky option for managing national finances.

- Scale: Even with dramatic price growth, Bitcoin’s total market cap is a fraction of the national debt, making it unlikely to significantly reduce the debt.

- Government Control: Bitcoin’s decentralized nature limits government control, which could conflict with traditional monetary policy.

-

Despite its potential for long-term price appreciation, there are several challenges to using Bitcoin

-

-

A Future Role for Bitcoin?

-

While Bitcoin is not a viable solution to the U.S. debt crisis, it may play a role in the future financial system. Accumulating Bitcoin while it’s in the blue/green zone could provide the U.S. with a hedge against inflation and a speculative asset that may appreciate over time. However, relying on Bitcoin alone would be risky and speculative.

Conclusion: Bitcoin in the Bigger Picture

Trump’s suggestion that Bitcoin could address the national debt raises interesting points about digital assets in future economic policy. However, can Bitcoin solve the U.S. national debt? The answer is complicated. While Bitcoin may offer long-term potential, it cannot solve the structural issues behind the U.S. debt. Instead, Bitcoin could serve as part of a diversified strategy to protect national wealth or hedge against inflation—but it’s far from a complete solution. Addressing the national debt will require broader fiscal reforms beyond the speculative potential of Bitcoin.

Disclosures: Not investment advice. The Author, Sarson Funds, Inc. and its affiliated managers may hold positions in the projects mentioned. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].