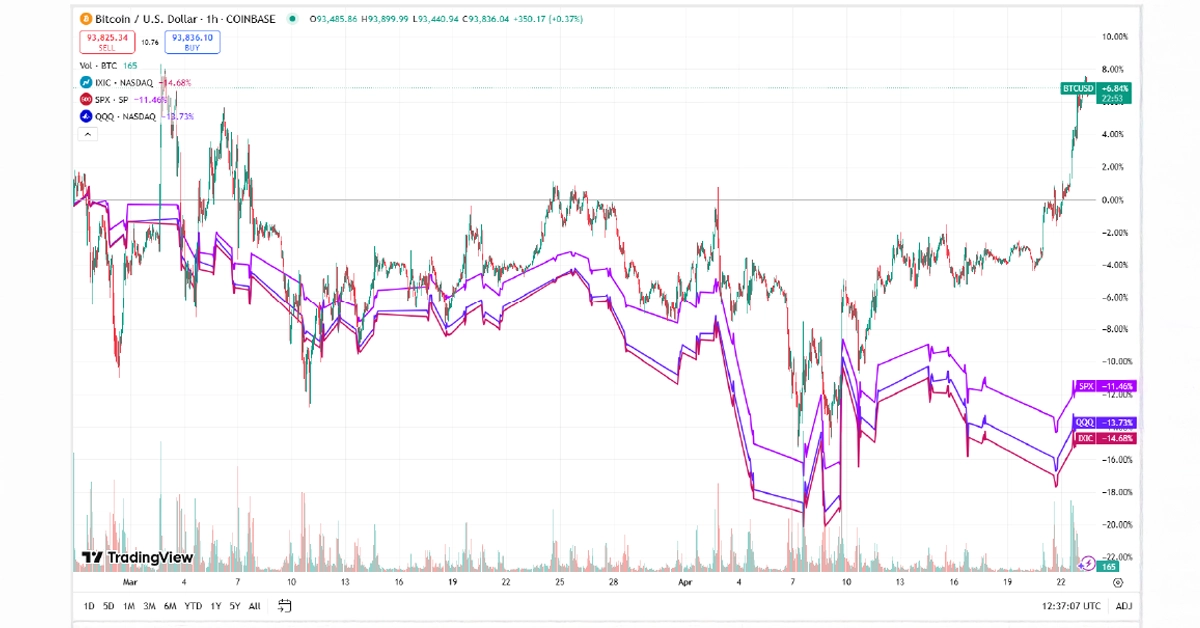

Bitcoin is outperforming the U.S. stock market, having gained around 11.5% over the past seven days, while the S&P 500 (SPX), Nasdaq Composite (IXIC), and Invesco QQQ (QQQ) have all declined. This divergence comes amid rising inflationary pressures and concerns about Federal Reserve rate hikes and tariff wars, which have weighed on equities particularly technology stocks while driving investors toward digital assets as an alternative hedge.

Interpreting Bitcoin as a Risk-Off Asset and Safe Haven

Analysts increasingly view Bitcoin’s resilience amid equity weakness as evidence of its evolving “digital gold” status. Price action suggests that, over the long run, BTC may behave as a risk-off asset offering portfolio diversification when stocks stumble. Crypto commentators note parallels with gold’s haven appeal, especially as investors seek shelter from currency debasement and geopolitical tensions.

Cantor Fitzgerald Joins Major Players in a $3 Billion Bitcoin Venture

According to multiple reports, Cantor Fitzgerald is teaming up with SoftBank, Tether, and Bitfinex to launch a $3 billion Bitcoin acquisition vehicle. The initiative, spearheaded by Brandon Lutnick of Cantor, will feed into a newly formed firm called 21 Capital.

Investment Breakdown

-

- Tether is committing $1.5 billion in BTC

The stablecoin issuer’s largest direct Bitcoin acquisition to date, signaling growing conviction in BTC as a reserve asset. - SoftBank will contribute $900 million

Continuing its push into digital infrastructure following major bets in fintech and AI. - Bitfinex adds $600 million

The exchange is leveraging its liquidity strength to support long-term institutional Bitcoin strategies.

- Tether is committing $1.5 billion in BTC

This structure aims to pool liquidity from major crypto and finance entities. Depending on market conditions, the venture could scale further and absorb additional Bitcoin, strengthening its position as a coordinated institutional acquisition vehicle.

Record Bitcoin Spot ETF Inflows Signal Renewed Institutional Interest

A staggering $936.43 million poured into Bitcoin Spot ETFs in a single day, marking the highest daily inflow recorded so far this year. Such flows reflect growing confidence among asset managers and hedge funds in BTC’s medium-term upside.

Bitcoin Reclaims $90,000 Level

On the heels of these ETF inflows, Bitcoin crossed back above $90,000, a psychological milestone not seen since early March. The rebound has reignited interest among institutional allocators, many of whom had sat on the sidelines in recent weeks amid regulatory uncertainties.

Conclusion

The confluence of Bitcoin’s independent price strength, a marquee $3 billion venture led by Cantor Fitzgerald and partners, and record ETF inflows paints a compelling picture: digital assets are carving out an identity distinct from traditional stocks, with growing recognition of BTC as a strategic safe-haven and portfolio diversifier. As these trends accelerate, both retail and institutional investors may increasingly look to Bitcoin to hedge against market turbulence and currency risks.

Disclosures: This article is for informational purposes only and should not be considered financial, legal, tax, or investment advice. It provides general information on cryptocurrency without accounting for individual circumstances. Sarson Funds, Inc. does not offer legal, tax, or accounting advice. Readers should consult qualified professionals before making any financial decisions. Cryptocurrency investments are volatile and carry significant risk, including potential loss of principal. Past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect those of Sarson Funds, Inc. By using this information, you agree that Sarson Funds, Inc. is not liable for any losses or damages resulting from its use.