PwC’s 2020 Crypto Hedge Fund Report highlights a Remarkable Year for Crypto Funds.

Faith in crypto is surging. In its continued emergence as a store of value asset class in the face of COVID-19, cryptocurrency investors have continually sought new ways to profit off of the emerging market. According to Price WaterhouseCoopers (PwC), an Enterprise Ethereum Alliance member, and Elwood Asset Management’s 2020 Crypto Hedge Fund Report, crypto hedge funds have experienced the recent momentum of digital assets, as they report an estimated doubling of crypto AUM across the world’s most successful digital asset investing institutions.

The report states, “by sharing these insights with the broader crypto industry, our goal is to encourage the adoption of sound practices by market participants as the ecosystem matures.” A heightening trust and maturing industry is surely displayed in their findings.

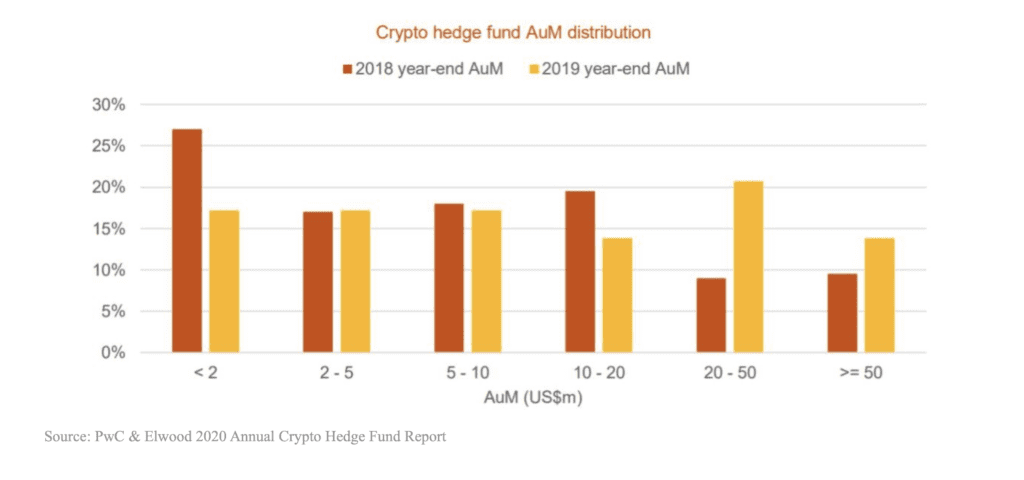

The report surveyed the world’s largest crypto hedge funds by AUM and found that global AUM has increased from $1 billion USD to over $2 billion through the past year. Also highlighted was an increase in the average and median AUM of these funds, with both measures doubling by year end as crypto funds’ average AUM was recorded at $44 million with a median of $8.2 million. The percentage of crypto funds managing at least 20 million AUM also experienced significant growth this year, rising from 19% in 2019 to 35% in their most recent results.

In lieu of crypto’s recent success, Henri Arslanian of PwC in a meeting with crypto news source The Block, said that “The changes the crypto hedge fund industry has seen in the past 12 months, from additional regulatory clarity to the accelerated implementation of best practices, are great examples of how fast the industry is becoming increasingly institutionalized.”

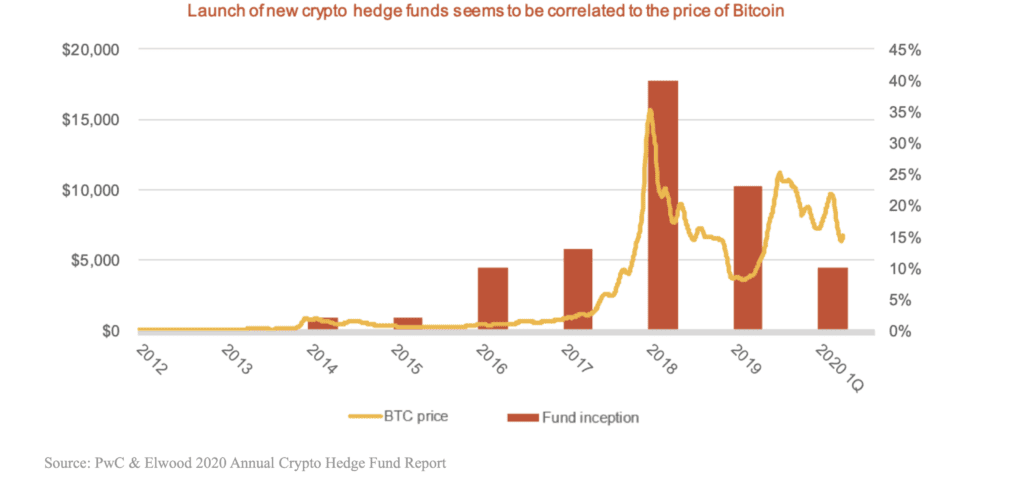

Fund Emergence Correlated with Bitcoin Price Activity

According to the report, the emergence of crypto hedge funds has closely followed the swings of bitcoin, as 40% of funds emerged following the 2017 all-time high and the slowed growth of new funds following the crypto winter in early 2019.

With such correspondence, the report recognizes that of all the holdings of these funds, 49% of daily trading is allocated towards Bitcoin, while 97% of these funds actively trade the asset in their investment strategies.

Among the top altcoins traded by these companies, 67% of funds reported to trade Ethereum (ETH), 38% traded both Ripple’s XRP and Litecoin (LTC), while 31% traded Bitcoin Cash (BCH). The depth of activity and attention that altcoins like these are receiving alongside Bitcoin within investment vehicles displays the maturation of digital assets that PwC and Elwood referred to in their report.

Common Investors and Investment Vehicles

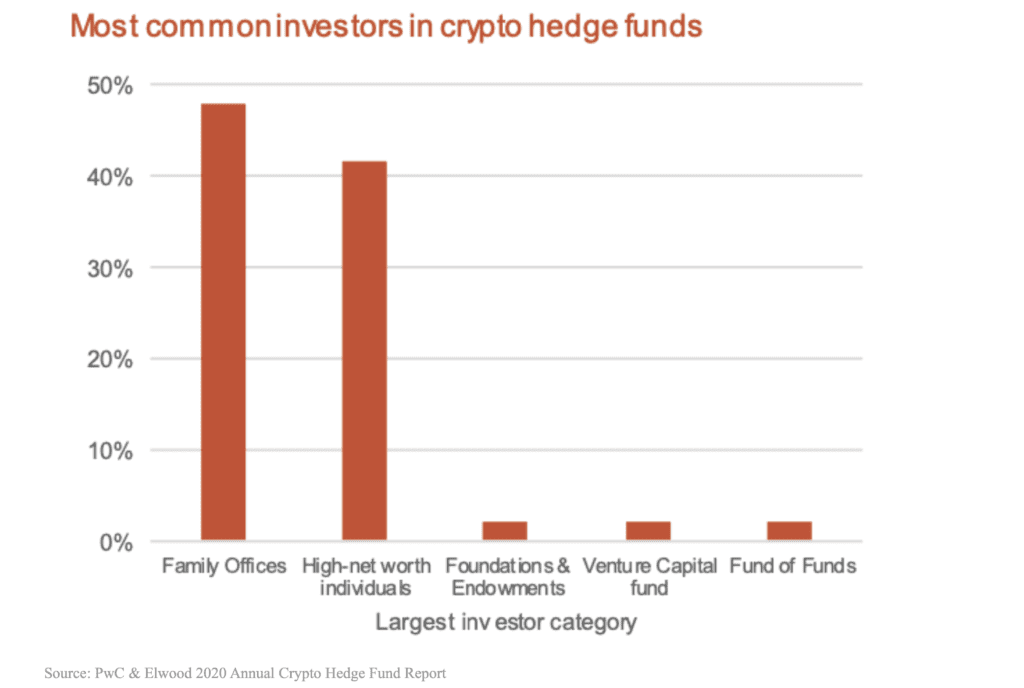

PwC and Elwood also reported that 48% percent of crypto hedge funds are owned by family offices, while 42% are under the umbrella of high-net-worth individuals. A rather notable measure is that venture capital funds make up just over three percent of crypto funds, displaying an unexpected underperformance in a sector that many would hope to greater embrace the momentum of blockchain technology.

Within the hedge funds reported, PwC and Elwood found that there are generally four types of crypto investment strategies, these being:

-

- Discretionary Long Only (funds with a long-term investor lock-up),

- Discretionary Long/Short (funds that take long and short strategies such as asset reallocation following industry events and technical analysis),

- Quantitative (liquidation backed strategies including arbitrage and market-making), and

- Multi-Strategy (combined strategies from the other three categories). Of these investment strategies, the most widely utilized are quantitative strategies, occupying almost half of all investment vehicles.

In the past year, the quantitative strategy was also the highest performing for surveyed funds, returning an average of 58% on the year, giving sense to why it is the most widely utilized approach. The Discretionary Long Only strategy acquired a 42% return, the Long/Short strategy tallied a 33% return, and the multi-strategy approach returned 19% on the year.

Breaking Down Investment Strategies

To further examine the quantitative strategy heavily utilized by crypto firms, PwC and Elwood also reported on the liquidation activities involved in the quant approach. Within their quantitative strategy, 56% of funds trade crypto derivatives, 48% actively short crypto assets, 38% engage with cash-settled futures, and 31% utilize options. Additionally, 42% of companies reported to engage in staking, 38% in lending, and 27% in borrowing.

Conclusion

While the asset class continues to mature, the findings of PwC and Elwood Asset Management mark 2019 as a tremendously successful year for crypto and the influx of capital into its’ associated investment funds. As attention has been brought to Bitcoin in the recent months, Sarson Funds is hopeful that while 2019 was a productive year, 2020 capital inflow will outperform the past year, especially with Bitcoin’s recent halving attracting larger than ever support for the asset class.

By Liam McDonald

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]