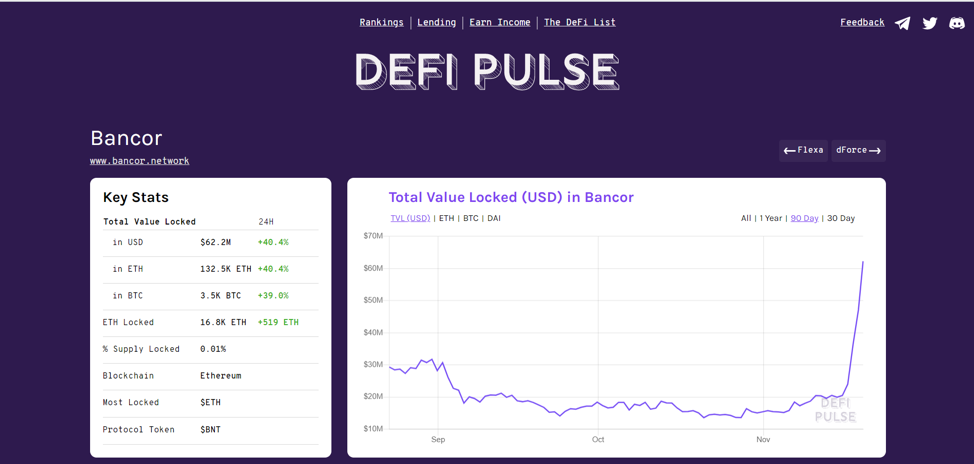

This week, Bancor Network launched their liquidity mining program. So far, the addition skyrocketed Bancor’s total value locked and has been a positive catalyst for its token price, which is up 50% this week. The goals for the Bancor liquidity mining program are to increase liquidity to its exchange and encourage LPs to stick around once the mining period ends through incorporating interesting features like single sided liquidity deposits and a stake and protect feature for liquidity providers.

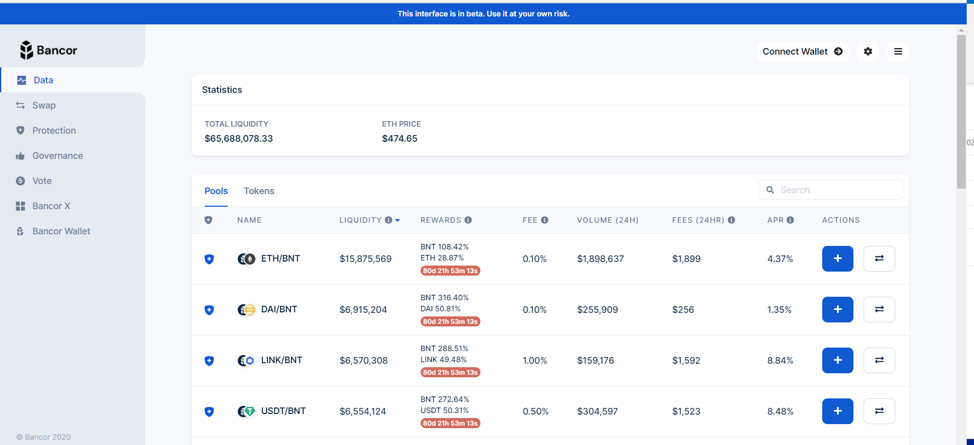

One of the main reasons why I was originally drawn to Bancor Network was because their stake and protect feature seems to be the perfect hedge against risk of impermanent loss. While Bancor provides inherent risk management opportunities, they originally did not have enough liquidity or volume to make it worthwhile to become a liquidity provider on their platform. Bancor’s liquidity mining program solves the original liquidity and volume issues of Bancor. Below, find images of the total value locked in the protocol and the liquidity mining reward APY’s investors could receive if they became an LP on Bancor.

Source: https://defipulse.com/bancor

Source: https://app.bancor.network/eth/data

In summary, if yield farmers are looking for high returns and mitigation of their impermanent loss risk, then Bancor Network is a great platform to provide liquidity.

By Jacob Stelter

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]